Non-Farm Employment Change came out much weaker than expected (126K vs. 246K exp), and previous was revised down to 264K from 295K. While Average Hourly Earnings surprised to the upside (0.3% vs. 0.2% exp), Participation Rate fell to 62.7% from 62.8%.

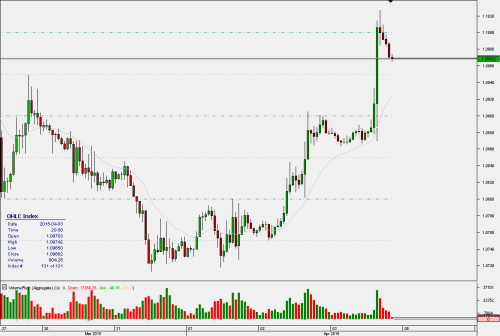

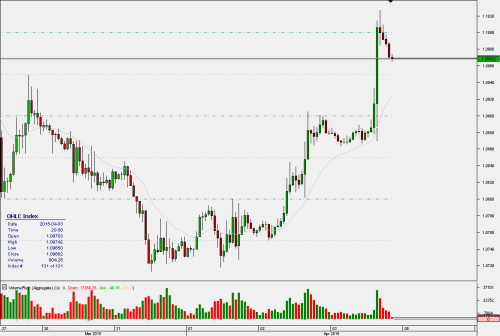

The biggest winners appear to be EUR/USD (pip-wise) and NZD/USD (percentage-wise), with USD/CAD also doing fine. Prices are pulling back at the moment, but that's not unusual after such overdone moves and right into holiday extended weekend.

Disappointing report, which may well keep USD offered for at least some days to come. We'll see soon enough as liquidity returns after Easter holidays.

The biggest winners appear to be EUR/USD (pip-wise) and NZD/USD (percentage-wise), with USD/CAD also doing fine. Prices are pulling back at the moment, but that's not unusual after such overdone moves and right into holiday extended weekend.

Disappointing report, which may well keep USD offered for at least some days to come. We'll see soon enough as liquidity returns after Easter holidays.