In my second blog post of the year I was arguing and making the point of higher market volatility in the year ahead, you can find more about it here: 2015 A Year of Higher Volatility

Did I ever foreseen the level of current madness in the market? By no means NO.

Having said that there where some clues of what is to come as everything was pointing towards ECB aggressive easing measures to be implemented at beginning of the year, and now with EU lawyer approving ECB bond-buying programme as being legal no one could be in denial anymore. Even though you could have make the case for ECB QE even from September last year when there where plenty of rumors with a draft that suggested they are making some test on the market to see how financial markets would respond to a $1T expansion in ECB balance sheet.

Brokers like Dukascopy have been preparing for a break of the 1.2 floor since then as they wisely reduced the leverage exposure to 1:10. I even heard Marc Spaelti Ducaskopy VP saying in one of the webinars, that behind the close doors they're talking to lower the cap, well they get rid of it all together, it seems Dukascopy was right about this.

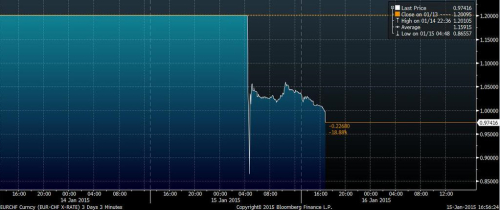

Figure 1. EUR/CHF BYE BYE 1.2000 Peg

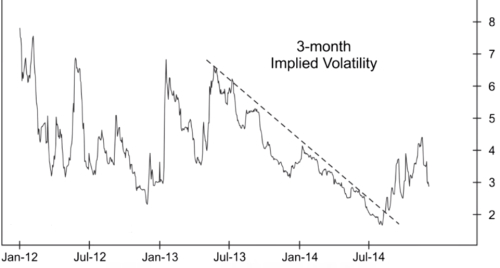

Another factor pointing towards a break of the peg was a big jump in fear about the CHF exchange rate, specifically the 3 Month implied volatility (see Figure 2) spiked from its lows in August 2014, that signals the rising fear in the markets for currency options. An more importantly that jump in fear happened while EUR/CHF was moving slowly towards the 1.2000 peg, this was a strong signal that something big may be about to happen.

Figure 2. 3-Month Implied Volatility

- SNB $80B Losses

If you're still confused on what has this to do with SNB and their 1.20 EUR/CHF peg, that let me tell you that SNB FX reserve is close to $500B, which would have not been enough to buy as much euro as would have need to protect the peg once ECB announced the QE, capisci?

Not to mention that the macro landscape has completely change since the time they introduced the peg, and if you thing that this is just a random event, I suggest you think twice, SNB announcement has come just after the other day ECJ has ruled in favor of ECB QE, and now the next day the SNB comes out and say;"Hey, sorry no more need of 1.20 PEG, bye bye"

Yesterday SNB has lost $80 billions on it's policy change, enough to wipe its entire net worth but if they would have not taken this steps, most likely next week when it's the ECB meeting they could have just gone broke, hypothetically.

- Brokers, Hedge Funds, Prop and the little guy all got busted

SNB is not the only one who lost big time, from the little retail guy to the macro hedge fund everyone got just CRASHED

People have no idea how this market function, especially during this times like a black swan event when there is no liquidity whatsoever, NADA, nothing! Banks don't stream any quotes because they have no idea either how to price this sh*t, the Forex market is just too fragmented even for their pricing models in this environment. Brokers have problems with their counterparties as they can't properly hedge with their liquidity providers.

No stop-loss order could have saved you in this environment, forget it, you're at the mercy of the market. I mean really, in this situation you would have pray to have a dealing desk broker model who guarantees stops (but still have some doubts that any provider will honour guaranteed stops in this situation) rather than STP ECN model. Almost every trade taken today in CHF pairs will be revisited after Brokers will settle their pricing with their liquidity providers. Now, all those market-making brokers are in deep sh*t as they most likely have not hedged those positions and as such, this positions are in the BIG red zone.

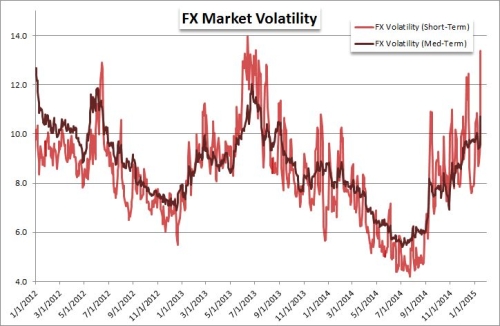

Figure 2. FX Market Volatility

Volatility goes through the roof (see Figure 2), ZERO liquidity. Traders can be lucky if they only lost just their accounts and don't owe the broker anything. Brokers have gone broke, confidence in the financial system dies and it can spread to other assets classes and some Macro Hedge Funds need to get a new job, that's the scary stuff.

After this tsunami there are traders who own their Broker anywhere from -$10K to -$400k, yes you heard that right, this are real story, read your Contract Agreement with any broker which say clearly:

You can lose more funds than you deposit in the margin account.

Some Brokers are out of business, I'm aware of 4 names but I won't advertise them here, and some are really big names in the industry. One of it's facing up to £30 million in losses after yesterday morning and not to mention that the biggest retail Broker went in a big hole with $225 Millions loss on their balance sheets:

I know Dukascopy has strong financials but still after this I'm wondering how they are doing after the tsunami?

I'm wondering also how many brokers are still alive, as the real question is: Are any survivors? as I smell blood on the streets.

- Few Words about my Trading Performance

Because of some reckless trading activity I blew it up again but not only in the Trader Contest but also my Dukat points. DEMO trading is just not for me I just can't trade in this environment, maybe this is because of my personality, but I'm better of focusing on my live account.

The "fun" part is this: even though I was bearish XXX/JPY pairs, and I really expected to go further down, but despite that, guess what? I took a long position, I thought maybe I'm wrong and the market will reverse, maybe my analysis is wrong I said to myself, so I took that stupid long trade which wiped my Trader Contest account.

- Final Words

I honestly feel sorry for the EUR/CHF longs (and other xxx/CHF pairs). I can't even begin to imagine what they're all going through. Days like this marks you forever. Just take one minute of your time and go check out on forums this stories on how traders lost everything. If you have been long enough in this business you should be scary as anytime you could lose just everything.

Just so you know I had no exposure in any CHF pair, nor with my live account or with my demo account.

I was about to write a lot more but I'm almost left speechless the more I think about what has just happened

RANT OVER!!!

PS: @CommunitySupport I think this blog post deserve to be pinned on the top of the page, Thanks!

Best Regards,

Daytrader21