If last week was all about US economic data this week prepare yourself to shift your focus to EU economic data and some and also some risk event coming from Australia as we'll have RBA's Monetary Policy announcement, the Unemployment figures and last but not least the Trade Balance figures.

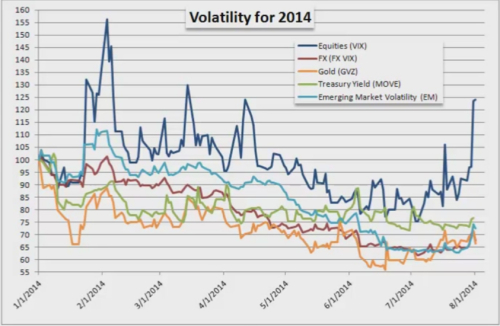

The events from past week has brought to surface some volatility as both the VIX and FX volatility spike higher and that's precisely what the whole trading world

has expected: the return of volatility. It may be the case that the low volatility (see Figure 1)is over as the summer trading condition are behind us and this only means we must change our trading strategies and be careful fading any move as we may get some big move ahead of us. When we had the low volatility environment it did make sense to fade all the moves in to support/resistance and to consider any breakout a false one but it all can change now with the return of volatility.

has expected: the return of volatility. It may be the case that the low volatility (see Figure 1)is over as the summer trading condition are behind us and this only means we must change our trading strategies and be careful fading any move as we may get some big move ahead of us. When we had the low volatility environment it did make sense to fade all the moves in to support/resistance and to consider any breakout a false one but it all can change now with the return of volatility.

Figure 1. Volatility Across Different Asset Classes

Now regarding the ECB meeting don't set higher expectation for new monetary policy as I don't think they are ready to change it that soon although the EU inflation has reached a new record low at 0.4% YOY in July but if you take in consideration the Core Inflation it's stable and much more higher at 0.8% YOY. So I'm expecting Mario Draghi to keep a dovish stance living forward guidance unchanged but this wont be enough to push the euro lower and we should see further short squeeze towards 1.3500 EUR/USD. I spoke about this even before NFP saying that there is a clear pattern that suggest we should go higher before resuming down here you can find more about it: What to Expect for Non-Farm Payrolls and here: EUR/USD Tapering Effect (part 2)

Best Regards,

Daytrader21