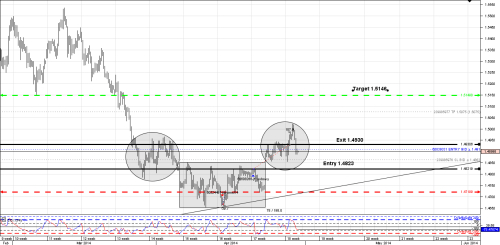

- In this blog i would like to explain my EUR/AUD trade idea ,how i got it and what is my wiew on long term for this pair.The trade idea come to me as i was conducting my daily analysis . O spotted an great opportunity in what looks like an inverted head & shoulder pattern.It is quite far from the regular look of the pattern but still in my eyes is very viable.

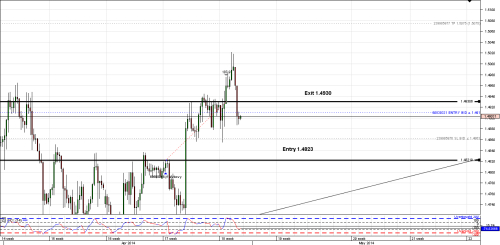

- I made my entry with a buy conditional order on 17 April at (1.4823) price level setting my TP at (1.5146) 300 pips, and SL at (1.4931) 109 pips.Due to the nature of the setup i was a bit more cautious with this trade and that is way i set a much close SL which was very close to be hit ,but the miracle came. After my entry the pair went into a steep sell wave of 104 pips ,5 pips away from the SL order.The sell wave was part of of the run towards retesting previous support with was rejected and send the pair higher.

- Due to the fact that this trade started with a significant DD, the trade run for more than 11 days. I let it run because i was really confident that the pair is bullish and i hoped to book some huge pips number. Unfortunately as i was incapable to monitor the trade closely i seted a closer SL in the profit area to limit the potential lose of my gains,and i got hit. The trade cloed with 106 pips profit. After closing the pair shoot another 90 pips before retracing.

- The setup of this pair is really excelent & strong.The pair is still bullish and from the look of it i see it rallying at least 200 pips and over before any revarsal or major retracement.While looking on a 1 Day chart for confirmation i sow that there is very strong support for a bullish rally. The tehnicals for this pair are great ,only fundamentals can ruin this prediction if the ECB will make an intervention in the markets to devaluate this late strong euro.

Metal_Mind