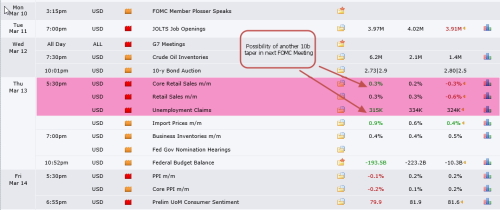

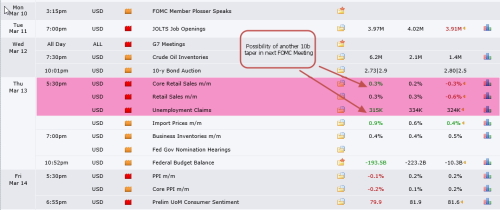

Upcoming week is considered another important week on USD pairs based on the fact that Fed is expected to taper another 10b in next FOMC Meeting as it is quite evident form their previous statements that Fed wants out of the asset purchase business on the belief that tapering is not tightening and even if it was tightening, they could compensate via forward guidance.

Despite recent data from US which strongly support another tapering EURUSD continues to go up and there are no signs yet of a sell-off on this pair. In fact from technical perspective there is still lot of room for price to go further up.

With Crimea Referendum and FOMC Meeting in upcoming week I am expecting some massive moves this week on US Dollar related pairs.

Despite recent data from US which strongly support another tapering EURUSD continues to go up and there are no signs yet of a sell-off on this pair. In fact from technical perspective there is still lot of room for price to go further up.

With Crimea Referendum and FOMC Meeting in upcoming week I am expecting some massive moves this week on US Dollar related pairs.