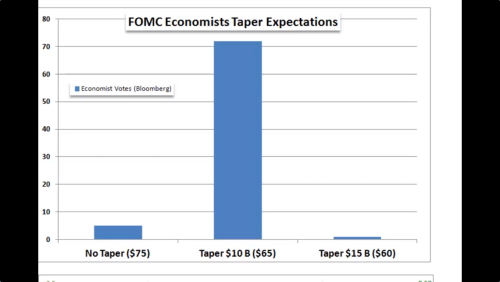

As expected Fed decided to continue with the current peace of of quantitative easing reduction at 10B/ meeting. In my yesterday blog post I've been highlighting why Fed is going to taper another 10B you can find my last blog post here: FOMC Statement another 10B Taper?

Best Regards,

Daytrader21.

- Figure 1. FOMC Economists Taper Expectation.

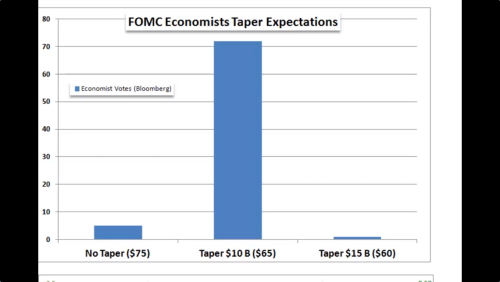

- Figure 2. Dollar Index and the taper.

Best Regards,

Daytrader21.