As I've been promised yesterday today I'm going to cover an interesting subject that many aspiring new trader are very confused about. You'll see this subject popping up on trading forums on a daily basis by novice traders who blame anyone else except themselves for their bad trades and losses. Many new traders and even traders who are in this business for years have this flawed idea that somehow your Broker hunts your SL order. So, Does your Broker hunt your stop loss?

As I've been promised yesterday today I'm going to cover an interesting subject that many aspiring new trader are very confused about. You'll see this subject popping up on trading forums on a daily basis by novice traders who blame anyone else except themselves for their bad trades and losses. Many new traders and even traders who are in this business for years have this flawed idea that somehow your Broker hunts your SL order. So, Does your Broker hunt your stop loss?The short answer to this question is : NO, they don't!

It's very risky for a Broker to push the market with artificial pricing to trigger your stop loss because they will be caught in very advantageous arbitrage opportunities and secondly they will have several legal repercussions and penalties. In my opinion there are two possibilities on how broker may hunt your SL and each of this options is very dangerous for a Broker to engage in and that's the reason why you'll NOT see this happening.

First case scenario is when the Broker is pushing artificial price JUST to your feed in order to hit your stop loss. It's very easy to see the Broker's benefits from this action but if you take in consideration the real RISK the Broker expose himself you will see that it's just not worth to engage with this tactics. The Real risk is the Broker can lose their license if they're caught doing this practices and soon they will be out of business. It's very easy to compare your data feed with another trader's data feed from the same Broker, and see the discrepancy between the price.

The second case scenario would be when the Broker send artificial price to all their clients. But if you're going to take in consideration the real risk you'll understand why they will not engage in this tactics. Actually if a Broker is doing this, it will be caught in very advantageous arbitrage opportunities that can be exploited and they wouldn't be able the hedge their exposure. I hope by now it's very clear why this idea that somehow your Broker is here to hunt your SL is so flawed.

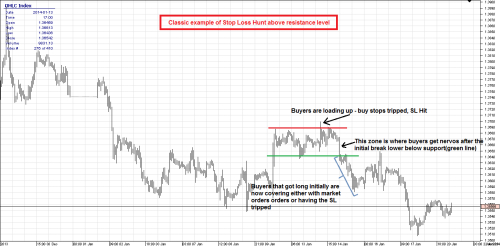

Now I'm going to cover this subject and give you some solid foundation of WHY? you'll see so often price hitting your stop loss order and than the market reverse. The Forex market speculation is a zero sum game and this mean that forevery dollar one trader profits, another trader must lose. In order to make consistent profits, you'll have to think and act like an order flow dealers.

You can have the best trading idea but if you can't find a counterparty to take the other side of your trade you'll have just an idea and no trade, so liquidity is the answer here, and understanding the market microstructure you'll see why so often your SL is hit, so it's the smart money who are in search of liquidity that is hunting your SL.

- Figure 1. EUR/USD 1h chart. Classic example of SL hunt above resistance level (click on picture to enlarge).

It's time for you to stop blaming your Broker for your losses and take responsibility for your actions and focus on learning what to do in order for your SL not to be hit and timing better the market will help you avoid unnecessary losses. I hope you liked my rant, give a thumbs up if that's the case.

Best Regards,

Daytrader21.