Full research

Video version of the report will be available here.

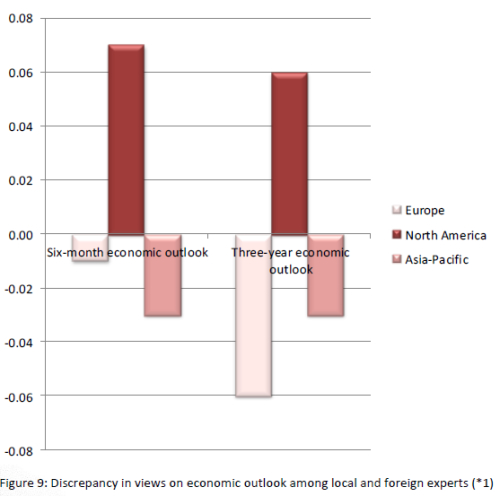

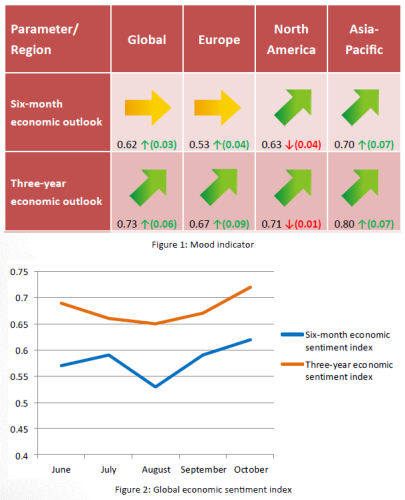

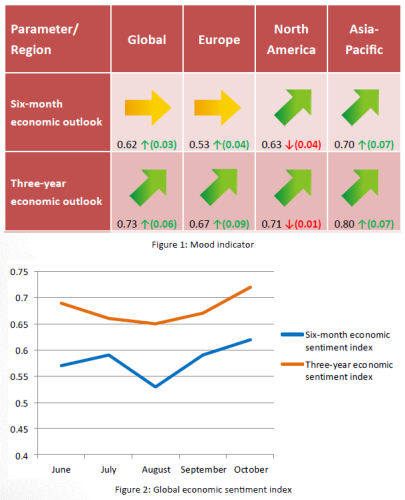

- The six-month and three-year global economic expectations improved in October, a Dukascopy Bank SA poll showed. The six-month economic sentiment index advanced 0.03 to 0.62. The three-year economic outlook improved 0.06 to 0.73.

- The European six-month economic sentiment index advanced 0.04 to 0.53, the highest reading since records began in 2011. The three-year outlook climbed to 0.67, from 0.58 in September.

- Respondents became less optimistic about the six-month and three-year North American economic outlooks in October. The six-month and three-year economic sentiment indices fell to 0.63 and 0.71 accordingly.

- The Asia-Pacific six-month and three-year expectations both climbed 0.07 to 0.70 and 0.80, respectively.

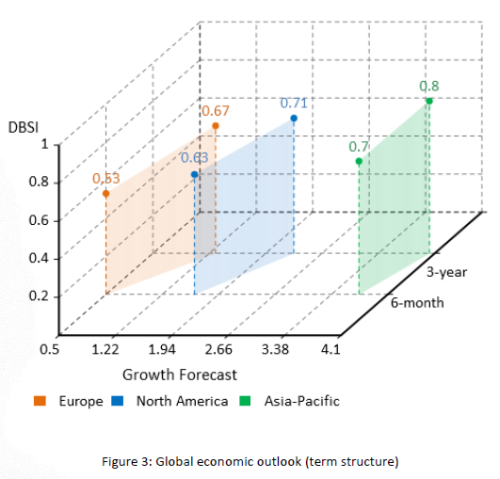

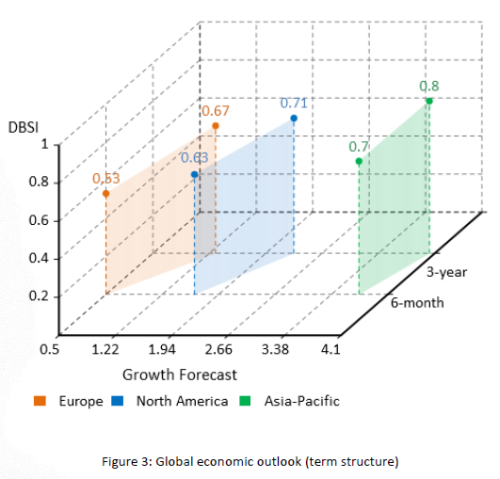

Figure 3 presents the term structure of the Dukascopy Bank Sentiment Index (Y-axis) mapped against GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.

Poll respondents suggest that the European economy will expand an annualized 0.50% six month from now and 1.30% three years from now.

Respondents revised the North American six-month and three-year economic growth forecasts to 1.63% and 2.30% in October, from 1.40% and 2.13% respectively in September.

The Asia-Pacific economic growth projections are the strongest. Experts forecast growth of 3.73% and 4.03% six months and three years from now accordingly.

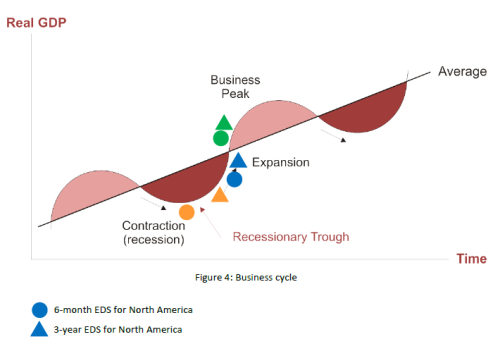

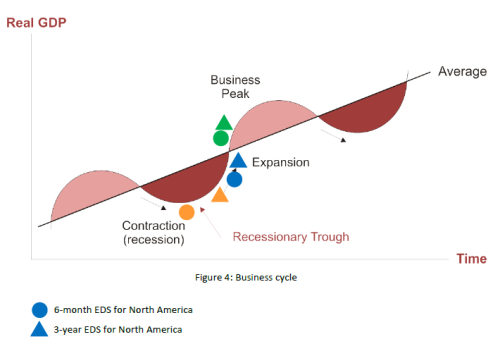

Figure 4 presents the business cycle and its phases - expansion (real GDP is increasing), peak (real GDP stops increasing and begins decreasing), contraction or recession (real GDP is decreasing), and trough (real GDP stops decreasing and begins increasing).

Respondents are divided on the European six-month EDS. Sixteen claim the economy will be in a recession, while fourteen say the economy will be expanding, yet twenty two expect that the regional economy will gather pace in three years time.

Majority of experts support the view that the North American economy will be expanding both six months and three years from now.

Experts are largely united about the Asia-Pacific 6-month EDS – twenty six forecast expansion and two say the economy will reach its peak. Twenty five respondents support the view that the Asia-Pacific economy will expand three years from now.

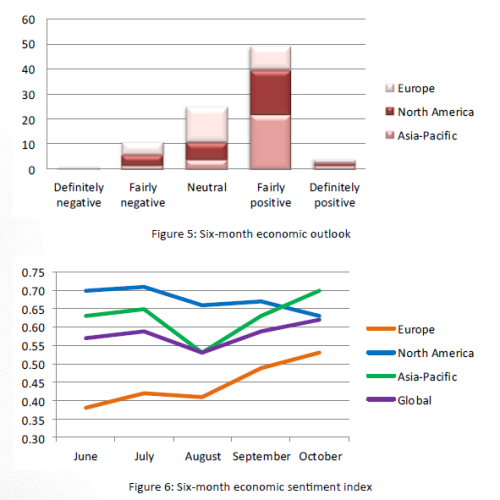

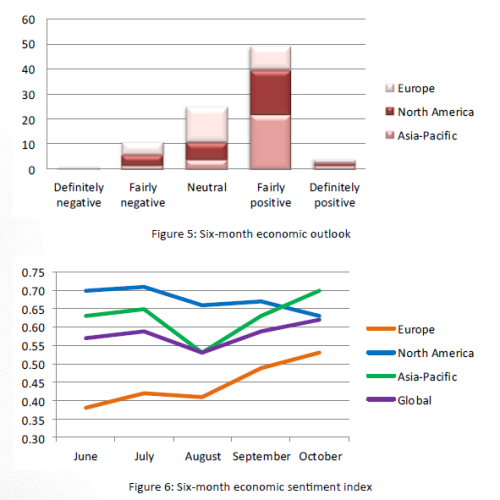

Figure 5 shows the six-month economic outlook for Europe, North America, and Asia-Pacific. The global six-month economic prospects advanced 0.03 to 0.62 in October.

The European six-month economic sentiment index advanced 0.04 to 0.53, the highest reading since records began in 2011. Six respondents (20%) are pessimistic about the economic outlook, fourteen (47%) say the outlook is “neutral” and the rest (33%) claim the outlook is “positive”.

The North American six-month economic prospects worsened. The sentiment index fell 0.04 to 0.63 from 0.67 in September. Yet nineteen experts (63%) claim the outlook is “fairly” or “definitely” positive and seven (23%) suggest the economic outlook is “neutral”.

The Asia-Pacific sentiment index inched to 0.70, up from 0.63 in September. Twenty four respondents (80%) are either “fairly” or “definitely” positive about the six-month economic outlook. Four (13%) say the outlook is “neutral”, whereas two (7%) claim the outlook is “fairly” negative.

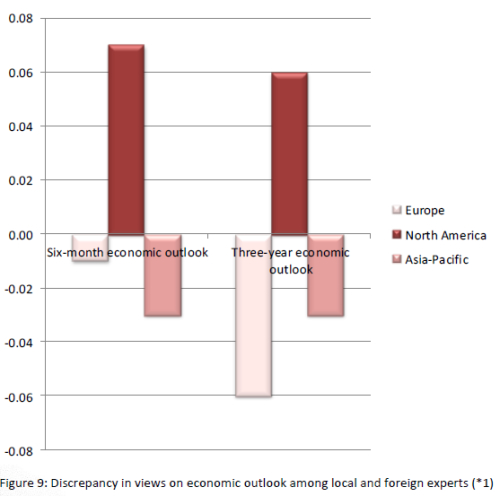

Figure 9 presents a discrepancy in views on the economic outlook among local and foreign experts. October poll results reveal that respondents from Asia-Pacific are less optimistic about the local economic outlook compared to their foreign colleagues.

Europe: Respondents from Europe are less optimistic about the regional six-month and three-year economic outlook compared to their foreign colleagues (0.53 vs. 0.54 and 0.63 vs. 0.69 respectively).

North America: Local Experts are more optimistic about the North American six-month economic prospects (0.68 vs. 0.61). The discrepancy in opinions reaches positive 0.06 for the three-year economic outlook.

Asia-Pacific: Local respondents are less optimistic (0.68) about the Asia-Pacific six-month economic prospects compared to foreign experts (0.71). The discrepancy in views remains unchanged at a value –0.03 for the three-year economic outlook.

Video version of the report will be available here.

- The six-month and three-year global economic expectations improved in October, a Dukascopy Bank SA poll showed. The six-month economic sentiment index advanced 0.03 to 0.62. The three-year economic outlook improved 0.06 to 0.73.

- The European six-month economic sentiment index advanced 0.04 to 0.53, the highest reading since records began in 2011. The three-year outlook climbed to 0.67, from 0.58 in September.

- Respondents became less optimistic about the six-month and three-year North American economic outlooks in October. The six-month and three-year economic sentiment indices fell to 0.63 and 0.71 accordingly.

- The Asia-Pacific six-month and three-year expectations both climbed 0.07 to 0.70 and 0.80, respectively.

Figure 3 presents the term structure of the Dukascopy Bank Sentiment Index (Y-axis) mapped against GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.

Poll respondents suggest that the European economy will expand an annualized 0.50% six month from now and 1.30% three years from now.

Respondents revised the North American six-month and three-year economic growth forecasts to 1.63% and 2.30% in October, from 1.40% and 2.13% respectively in September.

The Asia-Pacific economic growth projections are the strongest. Experts forecast growth of 3.73% and 4.03% six months and three years from now accordingly.

Figure 4 presents the business cycle and its phases - expansion (real GDP is increasing), peak (real GDP stops increasing and begins decreasing), contraction or recession (real GDP is decreasing), and trough (real GDP stops decreasing and begins increasing).

Respondents are divided on the European six-month EDS. Sixteen claim the economy will be in a recession, while fourteen say the economy will be expanding, yet twenty two expect that the regional economy will gather pace in three years time.

Majority of experts support the view that the North American economy will be expanding both six months and three years from now.

Experts are largely united about the Asia-Pacific 6-month EDS – twenty six forecast expansion and two say the economy will reach its peak. Twenty five respondents support the view that the Asia-Pacific economy will expand three years from now.

Figure 5 shows the six-month economic outlook for Europe, North America, and Asia-Pacific. The global six-month economic prospects advanced 0.03 to 0.62 in October.

The European six-month economic sentiment index advanced 0.04 to 0.53, the highest reading since records began in 2011. Six respondents (20%) are pessimistic about the economic outlook, fourteen (47%) say the outlook is “neutral” and the rest (33%) claim the outlook is “positive”.

The North American six-month economic prospects worsened. The sentiment index fell 0.04 to 0.63 from 0.67 in September. Yet nineteen experts (63%) claim the outlook is “fairly” or “definitely” positive and seven (23%) suggest the economic outlook is “neutral”.

The Asia-Pacific sentiment index inched to 0.70, up from 0.63 in September. Twenty four respondents (80%) are either “fairly” or “definitely” positive about the six-month economic outlook. Four (13%) say the outlook is “neutral”, whereas two (7%) claim the outlook is “fairly” negative.

Figure 9 presents a discrepancy in views on the economic outlook among local and foreign experts. October poll results reveal that respondents from Asia-Pacific are less optimistic about the local economic outlook compared to their foreign colleagues.

Europe: Respondents from Europe are less optimistic about the regional six-month and three-year economic outlook compared to their foreign colleagues (0.53 vs. 0.54 and 0.63 vs. 0.69 respectively).

North America: Local Experts are more optimistic about the North American six-month economic prospects (0.68 vs. 0.61). The discrepancy in opinions reaches positive 0.06 for the three-year economic outlook.

Asia-Pacific: Local respondents are less optimistic (0.68) about the Asia-Pacific six-month economic prospects compared to foreign experts (0.71). The discrepancy in views remains unchanged at a value –0.03 for the three-year economic outlook.