Here are two Chart as below as

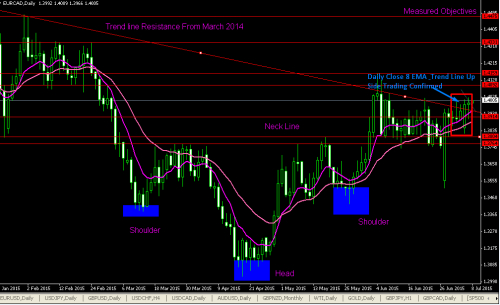

Euro pair we have been tracking since late May is EURCAD. Although the inverse head and shoulder pattern has taken a few hits recently from the weekly gaps, the pattern (surprisingly) remains intact.

In fact the reversal pattern was confirmed by the rally on June 2nd, however with trend line resistance from 2015 just above we were waiting for a clearer breakout opportunity. Yesterday’s price action appears to have produced such an opportunity.

Although not nearly as severe as last week’s gap, EURCAD experienced yet another gap down this week. This makes yesterday’s break of trend line resistance even more impressive as the pair had to climb more than 100 pips just to get back to last week’s close.

With yesterday’s price action behind us we can begin watching for buying opportunities on a retest of former resistance as new support. But again, be sure to factor in the likelihood of increased volatility in the Euro, which likely calls for trading a smaller position size.

Summary: Watch for a buying opportunity on a retest of former resistance as new support. Key resistance comes in at 1.4070, 1.4212 and 1.4330 with a measured objective of 1.4475.

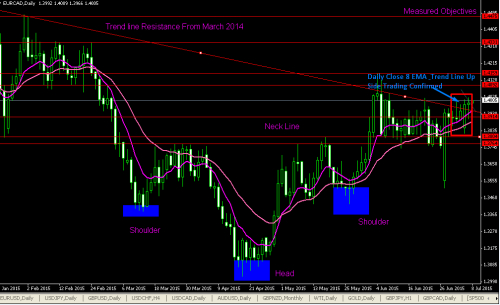

Euro pair we have been tracking since late May is EURCAD. Although the inverse head and shoulder pattern has taken a few hits recently from the weekly gaps, the pattern (surprisingly) remains intact.

In fact the reversal pattern was confirmed by the rally on June 2nd, however with trend line resistance from 2015 just above we were waiting for a clearer breakout opportunity. Yesterday’s price action appears to have produced such an opportunity.

Although not nearly as severe as last week’s gap, EURCAD experienced yet another gap down this week. This makes yesterday’s break of trend line resistance even more impressive as the pair had to climb more than 100 pips just to get back to last week’s close.

With yesterday’s price action behind us we can begin watching for buying opportunities on a retest of former resistance as new support. But again, be sure to factor in the likelihood of increased volatility in the Euro, which likely calls for trading a smaller position size.

Summary: Watch for a buying opportunity on a retest of former resistance as new support. Key resistance comes in at 1.4070, 1.4212 and 1.4330 with a measured objective of 1.4475.