It'll be a short week as many vacation deprived worker bees over in the U.S. are busy preparing for an extended 4th of July weekend. So expect low participation on the market front starting Wednesday and turning into a flatline on Thursday. Which unfortunately works against us this week as this is probably just the quiet before the storm. Since I was gone Friday I'll start this off with a wrap up of where we are followed by a few pointers on how to get positioned and of course some short term setups:

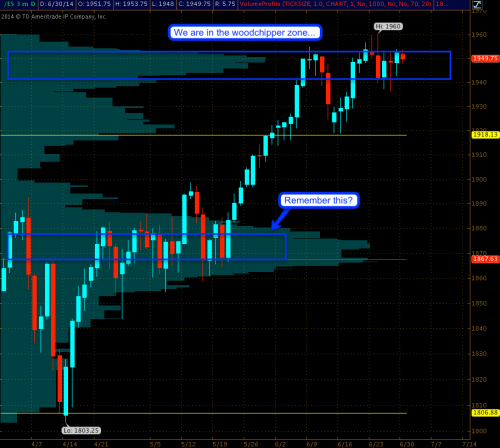

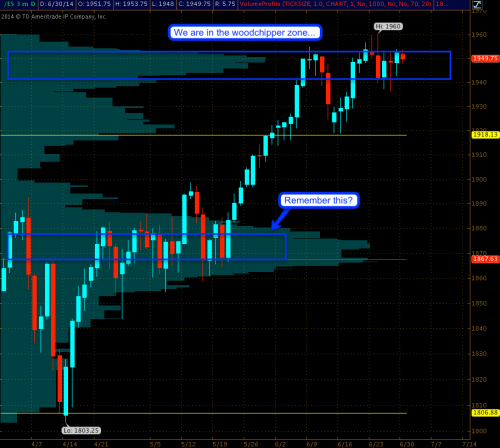

Here's the E-Mini volume profile. Apparently we are not only heading into a holiday weekend but we're also in the mid of a nasty chop suey zone. There is no saying how long it'll draw out but I concur with Scott when he advices that it's best not to be caught in between the swings.

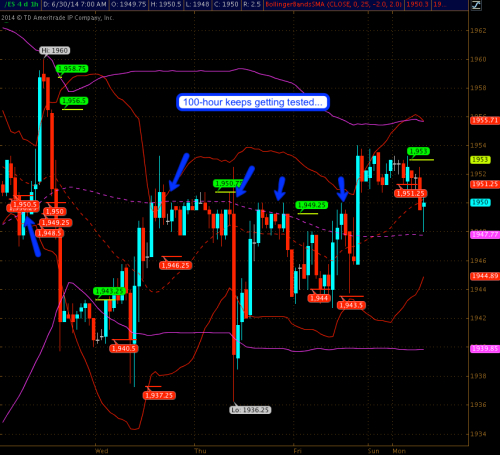

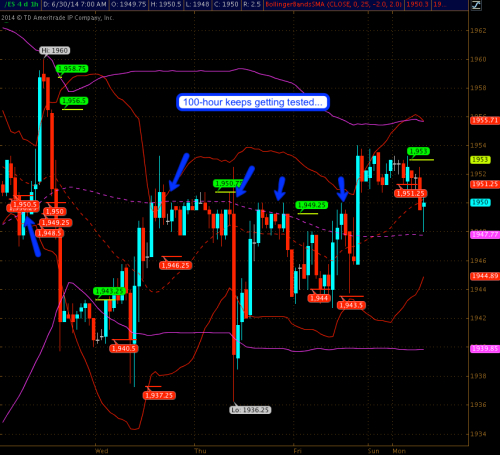

On the short term side the spoos are looking pretty ugly. The recurring theme appears to be a test of the 100-hour SMA - so if you must/need to play then you should use that one to your advantage.

Also on a short term basis - the GBP/JPY correlation we have been watching over the past few weeks. It's pointing down on a general basis. Watch this one during the session - if this divergence continues gravity may set in on the equities side.

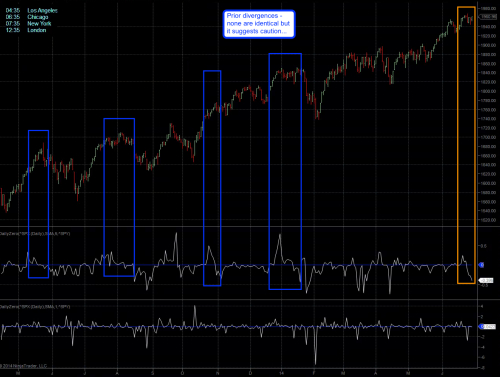

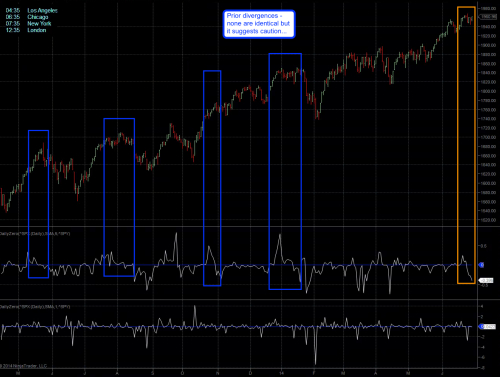

Which brings me to the big whopper. I updated the daily Zero this morning and was rather stunned by the extended divergence that has developed over the past week. As it runs on the daily chart we use it mainly to assess the overall trend and in particular to spot situations where the long side may become hazardous. I have highlighted prior occurrences and as you can see we usually get some kind of correction although its magnitude cannot be predicted. IF you are trading on a long term basis (i.e. daily or weekly charts) then I suggest you make sure that your stops are set where you need them to be. There is yet no reason to panic but I would follow price very carefully - I will be posting two equity setups below which should guide you through this week just fine.

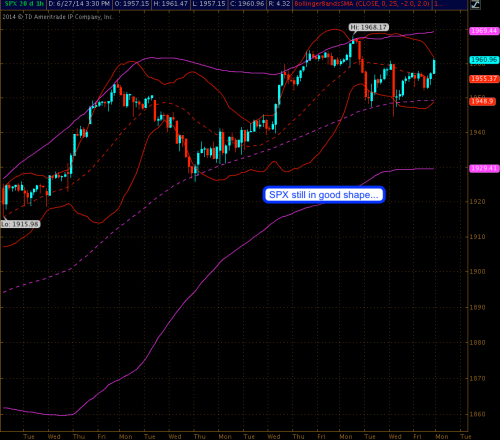

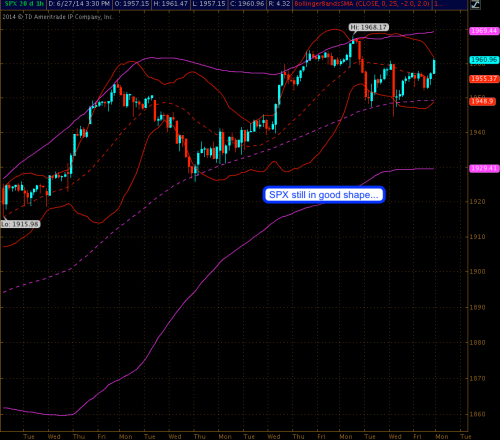

On the SPX cash side we are still in good shape and unless 1948 gives way any sudden drops to the downside are most likely going to find some dip buyers. However if that line is crossed things could accelerate quickly - an impending long weekend be damned.

More goodies below the fold - please step into my lair...

Here's the E-Mini volume profile. Apparently we are not only heading into a holiday weekend but we're also in the mid of a nasty chop suey zone. There is no saying how long it'll draw out but I concur with Scott when he advices that it's best not to be caught in between the swings.

On the short term side the spoos are looking pretty ugly. The recurring theme appears to be a test of the 100-hour SMA - so if you must/need to play then you should use that one to your advantage.

Also on a short term basis - the GBP/JPY correlation we have been watching over the past few weeks. It's pointing down on a general basis. Watch this one during the session - if this divergence continues gravity may set in on the equities side.

Which brings me to the big whopper. I updated the daily Zero this morning and was rather stunned by the extended divergence that has developed over the past week. As it runs on the daily chart we use it mainly to assess the overall trend and in particular to spot situations where the long side may become hazardous. I have highlighted prior occurrences and as you can see we usually get some kind of correction although its magnitude cannot be predicted. IF you are trading on a long term basis (i.e. daily or weekly charts) then I suggest you make sure that your stops are set where you need them to be. There is yet no reason to panic but I would follow price very carefully - I will be posting two equity setups below which should guide you through this week just fine.

On the SPX cash side we are still in good shape and unless 1948 gives way any sudden drops to the downside are most likely going to find some dip buyers. However if that line is crossed things could accelerate quickly - an impending long weekend be damned.

More goodies below the fold - please step into my lair...