In the first article in this series I outlined some general principles behind the strategies that I've been using in the contest. In the second article I described a simple process that can be used to improve the strategy, in terms of its entry signal. In the third article I explained why I switched to using mean-reversion entry signal instead of a trend-following one. This is also the strategy that I used in the May's contest.

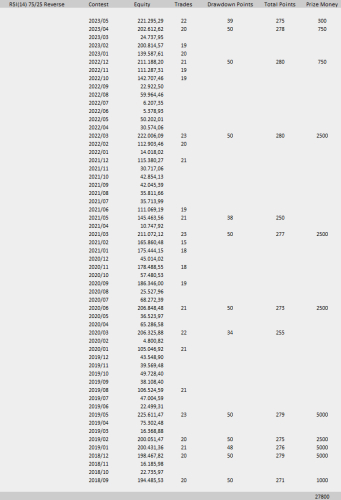

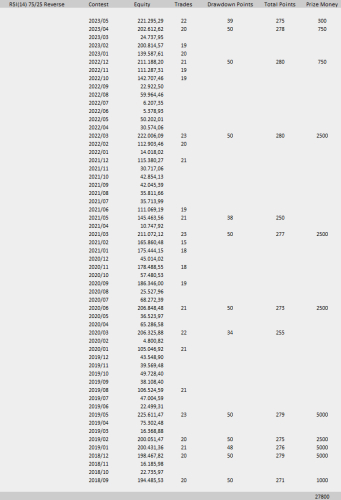

Below you can see the updated table with the expected prize money calculation. The first step of the calculation is using data from backtests where equity, number of trades and drawdown percent are determined. Then, assuming maximum bonus points (publishing strategy on the first day of a contest month), historical contest data is used to infer performance and drawdown points, then summing everything up to get total points. The actual results may be slightly different due to the reasons given in the previous article.

As pointed out earlier in the series, this strategy was designed for usage on a contest account, optimized for obtaining as much prize money as possible and caring little about the usual performance metrics, as is aggregate P/L for example. However, it would be interesting to explore how could one go about adapting the strategy (or parts of it) for a live trading account where money has real value.

In order to do that it would be useful to ask where the potential advantage might come from. With this strategy, definitely not from money management and likely not from forcing the strategy to trade on the first signal every day only. Perhaps starting with the signal and finding out in what conditions it works best. That could be as simple as applying a filter such as above 20-period simple moving average for buy signals and below 20-period simple moving average for sell signals.

While good entry points are important, exit strategy is what ultimately determines the overall profitability. Because a great strategy must work well over many years in the backtest, some kind of volatility-based stop loss and take profit orders are probably essential. Furthermore, I'd say that every part of the design must have a logical and simple explanation for its expected positive contribution to the strategy.

I'd like to thank to Dukascopy for the prize and for organizing this contest, which gives us opportunity to win funds for our trading accounts, expand our knowledge of markets and automated trading, and hone our programming skills at the same time.

Below you can see the updated table with the expected prize money calculation. The first step of the calculation is using data from backtests where equity, number of trades and drawdown percent are determined. Then, assuming maximum bonus points (publishing strategy on the first day of a contest month), historical contest data is used to infer performance and drawdown points, then summing everything up to get total points. The actual results may be slightly different due to the reasons given in the previous article.

As pointed out earlier in the series, this strategy was designed for usage on a contest account, optimized for obtaining as much prize money as possible and caring little about the usual performance metrics, as is aggregate P/L for example. However, it would be interesting to explore how could one go about adapting the strategy (or parts of it) for a live trading account where money has real value.

In order to do that it would be useful to ask where the potential advantage might come from. With this strategy, definitely not from money management and likely not from forcing the strategy to trade on the first signal every day only. Perhaps starting with the signal and finding out in what conditions it works best. That could be as simple as applying a filter such as above 20-period simple moving average for buy signals and below 20-period simple moving average for sell signals.

While good entry points are important, exit strategy is what ultimately determines the overall profitability. Because a great strategy must work well over many years in the backtest, some kind of volatility-based stop loss and take profit orders are probably essential. Furthermore, I'd say that every part of the design must have a logical and simple explanation for its expected positive contribution to the strategy.

I'd like to thank to Dukascopy for the prize and for organizing this contest, which gives us opportunity to win funds for our trading accounts, expand our knowledge of markets and automated trading, and hone our programming skills at the same time.