Strategy "EURSIGNALFROMJPY", i uses around year, and this is not big modifying of "RSI8HOURJPY" with which i returned in strategy contest less than 2 years ago. Main change that new pair for trade have less spread, EUR/USD don't know rivals in this. I think, it is a one of reasons that new strategy more times was able to jump in prizes places.

Trade logic.

Strategy "EURSIGNALFROMJPY" opens new trade after night rollover, as fast as trading hours become have more liquidity, because no mood for losing important competitive points on big nighty spread. It is time of night session, and i think that yen should be more active in these hours relatively to others major currencies, which mainly presented of european pairs EUR and GBP, and top one USD already represented in any major pair. When motion in dollar is main for motions in all major pairs, than eur/usd and usd/jpy should have some visible correlation.

So, trading is going on eur/usd pair. But signal for trade on asian session taken from jpy/usd pair, instead eur/usd. Because yen is a bit more active on this session.

On picture with eur/usd ( timeframe 15min used for embrace 2 days, different situations with rollover) , are shown area and time of consolidation on forex in nighty rollover. Trades will be open on this chart.

On picture with usd/jpy, are using timeframe 5min and shown RSI indicator. From this chart, scipt are taken signal.

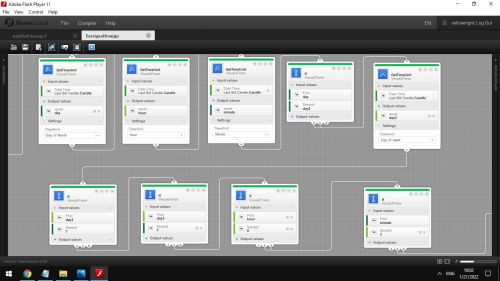

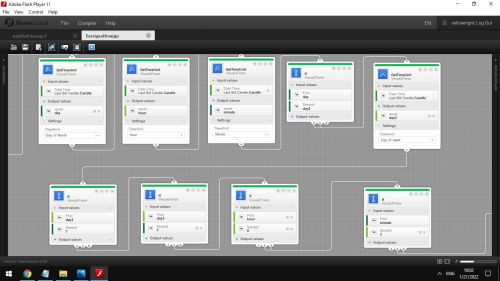

Code notes. I uses RSI oscillator, among big family of indicators ( MACD, boB, RSI, CCI, ADI and etc.), because RSI have simple interpretation. Signal taken via RSI indicator with very modest settings, timeframe 5 minutes with period 6. When no hard consolidation on market, such setting should cause opening order pretty fast.

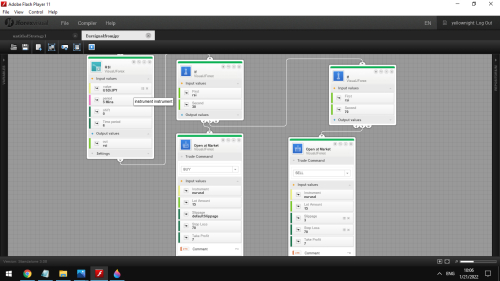

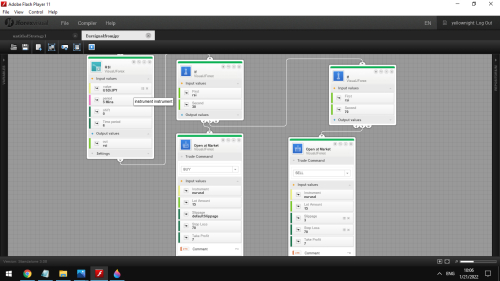

When band of RSI on jpy/usd pair falls below 30 it drives to open BUY order in pair eur/usd, and visa versa, when band of RSI in first pair goes higher than 70 it drives to open SEll order in another pair. Stop loss is 70 pips, as it is range of margin call on leverage 1:100, take profit various from 3 pips and more, used in different versions of strategy, it is one difference in them.

What about lot of strategy, since as the strategy does not plan to be in a trade for a long time and also not have losing trades, therefore only the maximum lot in the competition.

For determining time of open trades after night rollover are used this block, where weekends are eliminated ( all except days 7-saturday and 1 - sunday), and the first hour after the nightly rollover ( all except hour after 0 GMT), where trading is hindered by an expanded spread. Few minutes ( all except first 3minutes ) in the beginning of hour is also excluded to allow indicator RSI to overcome the noise after the overnight consolidation, or even noise of first minutes of hour that are affected by news.

Trade logic.

Strategy "EURSIGNALFROMJPY" opens new trade after night rollover, as fast as trading hours become have more liquidity, because no mood for losing important competitive points on big nighty spread. It is time of night session, and i think that yen should be more active in these hours relatively to others major currencies, which mainly presented of european pairs EUR and GBP, and top one USD already represented in any major pair. When motion in dollar is main for motions in all major pairs, than eur/usd and usd/jpy should have some visible correlation.

So, trading is going on eur/usd pair. But signal for trade on asian session taken from jpy/usd pair, instead eur/usd. Because yen is a bit more active on this session.

On picture with eur/usd ( timeframe 15min used for embrace 2 days, different situations with rollover) , are shown area and time of consolidation on forex in nighty rollover. Trades will be open on this chart.

On picture with usd/jpy, are using timeframe 5min and shown RSI indicator. From this chart, scipt are taken signal.

Code notes. I uses RSI oscillator, among big family of indicators ( MACD, boB, RSI, CCI, ADI and etc.), because RSI have simple interpretation. Signal taken via RSI indicator with very modest settings, timeframe 5 minutes with period 6. When no hard consolidation on market, such setting should cause opening order pretty fast.

When band of RSI on jpy/usd pair falls below 30 it drives to open BUY order in pair eur/usd, and visa versa, when band of RSI in first pair goes higher than 70 it drives to open SEll order in another pair. Stop loss is 70 pips, as it is range of margin call on leverage 1:100, take profit various from 3 pips and more, used in different versions of strategy, it is one difference in them.

What about lot of strategy, since as the strategy does not plan to be in a trade for a long time and also not have losing trades, therefore only the maximum lot in the competition.

For determining time of open trades after night rollover are used this block, where weekends are eliminated ( all except days 7-saturday and 1 - sunday), and the first hour after the nightly rollover ( all except hour after 0 GMT), where trading is hindered by an expanded spread. Few minutes ( all except first 3minutes ) in the beginning of hour is also excluded to allow indicator RSI to overcome the noise after the overnight consolidation, or even noise of first minutes of hour that are affected by news.