Hello, I won the first place in last month strategy contest and I will explain in this blog the strategy I used.

The strategy is based on the well-known Martingale system. I have chosen this strategy because it offers the possibility to compensate the losses and thus to achieve a constantly growing profit. However, the strategy is also very risky and if the price goes sideways or if there are large price fluctuations, the capital can very quickly be zero. Therefore, the use of this strategy is not suitable and not recommended for live trading.

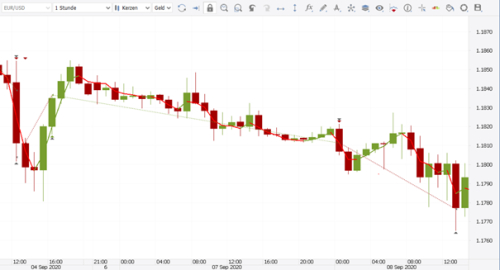

For the strategy I use the indicators, TEMA (in different time periods), ADX (14), RSI (14) and MACD (12/26/9) to find a good entry point. On the following photos you can see the indicators TEMA, RSI, ADX and MACD in the 1 hour period, one of my trend control periods:

1 hour chart:

To enter the market the TEMA indicator in the 6 different periods, 1 min TEMA (70), 5 min TEMA (50), 1 hour TEMA (30), 4 hours TEMA (30), daily TEMA (15) and weekly TEMA (7), must show in the same direction.

When the current TEMA candle value of all these 6 periods is lower then the last TEMA candle value, a short position is opened. At the same time, the following control values must be observed:

- In the 1 hour control period, the current MACD (12/26/9) candle value must be lower then the previous MACD (12/26/9) candle value.

- The ADX (14) indicator in the 5 min and the 4 hours period must be beyond the value 20

- The RSI (14) value in the following periods must be higher the value of 20: 1 min period, 5 min period, 1 hour period, 4 hours period and daily period.

The following pictures shows the entry into a short position on 2 September, 07:20 under compliance with the criteria.

1 min chart, the TEMA (70) goes down, as you can see the indicator is coloured red and the RSI is higher than 20:

5 min chart, the TEMA (50) goes down, as you can see the indicator is coloured red, the ADX is above 20 and the RSI is higher than 20:

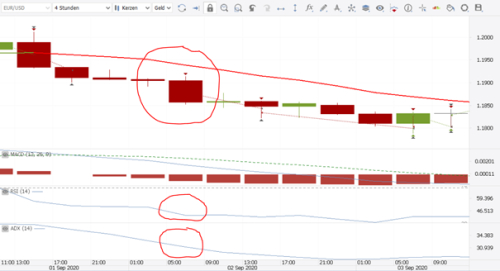

1 hour chart, the TEMA (30) goes down, as you can see the indicator is coloured red, the actual MACD (12/26/9) candle value is lower then the previous MACD (12/26/9) candle value and the RSI is higher than 20:

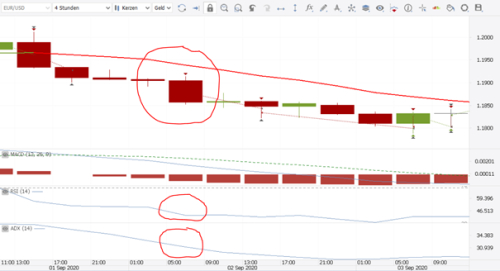

4 hours chart, the TEMA (30) goes down, as you can see the indicator is coloured red, the ADX is above 20 and the RSI is higher than 20:

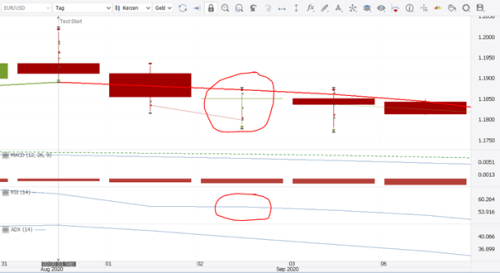

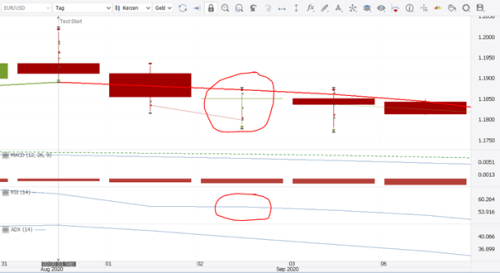

Daily chart, the TEMA (15) goes down, as you can see the indicator is coloured red and the RSI is higher than 20:

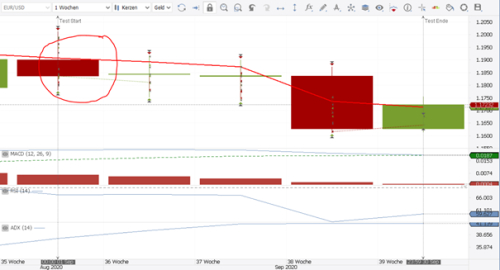

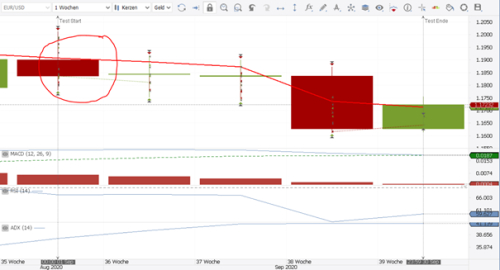

Weekly chart, the TEMA (7) is going down, as you can see the indicator is coloured red

For a long position, the logic is exactly the opposite.

The strategy works in the EUR/USD currency pair with an initial trade amount of 0.5 million. The trade amount is changing proportional to the equity. The stop loss is set to 25 pips and the take profit is set to 35 pips. Thus, the difference between loss and profit is large enough to make a nice profit.

After a position has been closed with loss, the main task of the strategy begins, namely, to replace each lost position with a larger position in the direction of the TEMA indicators, thus trying to make up for the loss. This happens until a position closes with profit or the capital is used up.

For this I used the following logic:

If the last closed trading position was a long position and this position was closed with a loss and if one of the following TEMA indicators, 1 hour TEMA (30), 4 hours TEMA (30), daily TEMA (15), weekly TEMA (7) are going downwards, than a short position will be opened with the new trade amount multiplied by 2.5 with SL 25 and TP 35.

If the last closed trading position was a short position the logic is vice versa.

All this is calculated by the strategy and can be viewed in VisualJForex.

Here is an example how the proportional change of the trade amount is calculated:

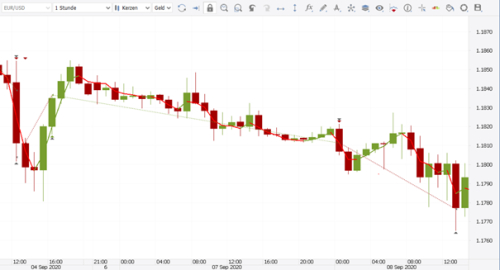

This is how the strategy works until a position can be closed with profit, as shown in the example here:

Thank you very much and I wish you all good profits.

The strategy is based on the well-known Martingale system. I have chosen this strategy because it offers the possibility to compensate the losses and thus to achieve a constantly growing profit. However, the strategy is also very risky and if the price goes sideways or if there are large price fluctuations, the capital can very quickly be zero. Therefore, the use of this strategy is not suitable and not recommended for live trading.

For the strategy I use the indicators, TEMA (in different time periods), ADX (14), RSI (14) and MACD (12/26/9) to find a good entry point. On the following photos you can see the indicators TEMA, RSI, ADX and MACD in the 1 hour period, one of my trend control periods:

1 hour chart:

To enter the market the TEMA indicator in the 6 different periods, 1 min TEMA (70), 5 min TEMA (50), 1 hour TEMA (30), 4 hours TEMA (30), daily TEMA (15) and weekly TEMA (7), must show in the same direction.

When the current TEMA candle value of all these 6 periods is lower then the last TEMA candle value, a short position is opened. At the same time, the following control values must be observed:

- In the 1 hour control period, the current MACD (12/26/9) candle value must be lower then the previous MACD (12/26/9) candle value.

- The ADX (14) indicator in the 5 min and the 4 hours period must be beyond the value 20

- The RSI (14) value in the following periods must be higher the value of 20: 1 min period, 5 min period, 1 hour period, 4 hours period and daily period.

The following pictures shows the entry into a short position on 2 September, 07:20 under compliance with the criteria.

1 min chart, the TEMA (70) goes down, as you can see the indicator is coloured red and the RSI is higher than 20:

5 min chart, the TEMA (50) goes down, as you can see the indicator is coloured red, the ADX is above 20 and the RSI is higher than 20:

1 hour chart, the TEMA (30) goes down, as you can see the indicator is coloured red, the actual MACD (12/26/9) candle value is lower then the previous MACD (12/26/9) candle value and the RSI is higher than 20:

4 hours chart, the TEMA (30) goes down, as you can see the indicator is coloured red, the ADX is above 20 and the RSI is higher than 20:

Daily chart, the TEMA (15) goes down, as you can see the indicator is coloured red and the RSI is higher than 20:

Weekly chart, the TEMA (7) is going down, as you can see the indicator is coloured red

For a long position, the logic is exactly the opposite.

The strategy works in the EUR/USD currency pair with an initial trade amount of 0.5 million. The trade amount is changing proportional to the equity. The stop loss is set to 25 pips and the take profit is set to 35 pips. Thus, the difference between loss and profit is large enough to make a nice profit.

After a position has been closed with loss, the main task of the strategy begins, namely, to replace each lost position with a larger position in the direction of the TEMA indicators, thus trying to make up for the loss. This happens until a position closes with profit or the capital is used up.

For this I used the following logic:

If the last closed trading position was a long position and this position was closed with a loss and if one of the following TEMA indicators, 1 hour TEMA (30), 4 hours TEMA (30), daily TEMA (15), weekly TEMA (7) are going downwards, than a short position will be opened with the new trade amount multiplied by 2.5 with SL 25 and TP 35.

If the last closed trading position was a short position the logic is vice versa.

All this is calculated by the strategy and can be viewed in VisualJForex.

Here is an example how the proportional change of the trade amount is calculated:

This is how the strategy works until a position can be closed with profit, as shown in the example here:

Thank you very much and I wish you all good profits.