TheCure2023

Thanks Dukascopy for such a wonderful opportunity to present my strategy and get the prize place.

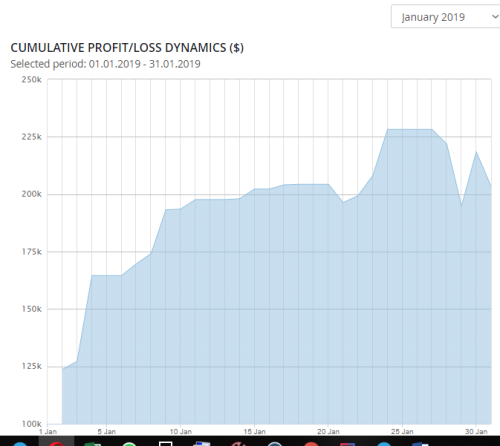

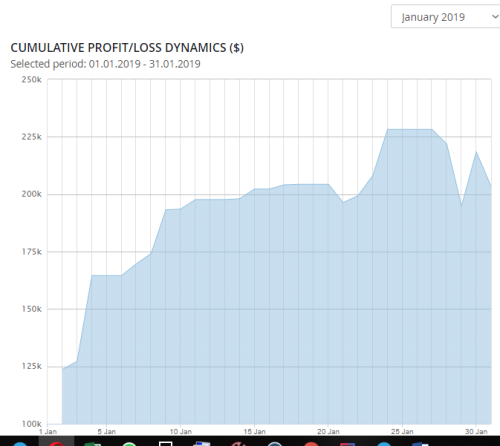

Ver1- based on tick price action. Therefore, this is my first strategy that has no indicators. It was built in Visual JForex and has the following logic:

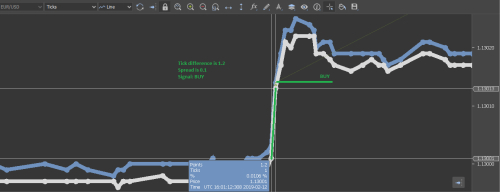

It read ticks for a difference between last and previous ticks that is more or equal to 1pip and a spread of 0.1 pips.

Money Management: SL is 33 and TP is 130 and Trailing is 12 pips. Amount - 5 lots. In this strategy we don't have a TP as an order, but we have a PL value that is onCandle check the value order.getProfitLossinPips(), and if this value is more or equal to PL, we close the order. It has a Martingale method that doubles the amount each loss.

Money Management: SL is 33 and TP is 130 and Trailing is 12 pips. Amount - 5 lots. In this strategy we don't have a TP as an order, but we have a PL value that is onCandle check the value order.getProfitLossinPips(), and if this value is more or equal to PL, we close the order. It has a Martingale method that doubles the amount each loss.

Every day we have only 1 positive order than wait till the next day. If order closed in a loss, we trade again with martingale until all losses will be covered up.

OnCandle each hour it checks if ProfitLossInPips is more or equal to 0 pips.

Than on Daily candles, it checks if last balance were covered up and switches to normal mode - One Positive trade a day!

Version 2 has the following changes:

OnCandle if on Hour candle ProfitLoss is not more than 0, it forces to change PL to 1pip. If the system is in recovery mode, it changes PL to 130 pips.

SL is 17 pips and trailing remained 12 pips. All this option made the system safer.

So as for me, I'm still doing some researches and going to adapt this strategy on other instruments and trade it on LIVE account.

Thanks Dukascopy for such a wonderful opportunity to present my strategy and get the prize place.

Ver1- based on tick price action. Therefore, this is my first strategy that has no indicators. It was built in Visual JForex and has the following logic:

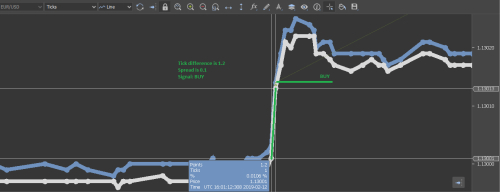

It read ticks for a difference between last and previous ticks that is more or equal to 1pip and a spread of 0.1 pips.

- Instrument - GBP/USD.

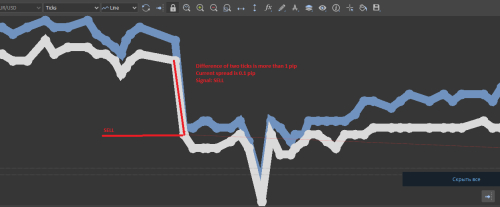

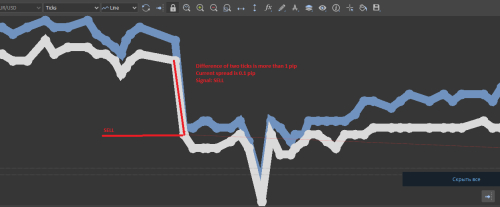

- It read ticks for a difference between last and previous ticks that is more or equal to 1pip and a spread of 0.3 pips.

- Thus if lastTick>PreviousTick on 1 or more pips and current spread is 0.3 we BUY.

- If lastTick is less then PreviousTick with the same condition - SELL.

Money Management: SL is 33 and TP is 130 and Trailing is 12 pips. Amount - 5 lots. In this strategy we don't have a TP as an order, but we have a PL value that is onCandle check the value order.getProfitLossinPips(), and if this value is more or equal to PL, we close the order. It has a Martingale method that doubles the amount each loss.

Money Management: SL is 33 and TP is 130 and Trailing is 12 pips. Amount - 5 lots. In this strategy we don't have a TP as an order, but we have a PL value that is onCandle check the value order.getProfitLossinPips(), and if this value is more or equal to PL, we close the order. It has a Martingale method that doubles the amount each loss.Every day we have only 1 positive order than wait till the next day. If order closed in a loss, we trade again with martingale until all losses will be covered up.

OnCandle each hour it checks if ProfitLossInPips is more or equal to 0 pips.

Than on Daily candles, it checks if last balance were covered up and switches to normal mode - One Positive trade a day!

Version 2 has the following changes:

OnCandle if on Hour candle ProfitLoss is not more than 0, it forces to change PL to 1pip. If the system is in recovery mode, it changes PL to 130 pips.

SL is 17 pips and trailing remained 12 pips. All this option made the system safer.

So as for me, I'm still doing some researches and going to adapt this strategy on other instruments and trade it on LIVE account.