Highlights

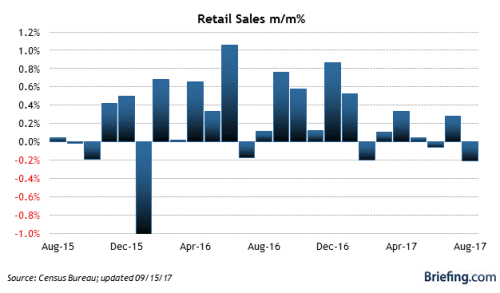

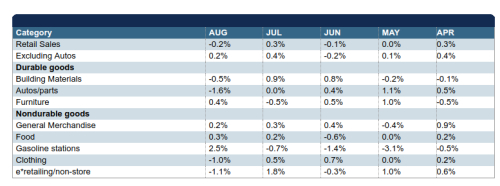

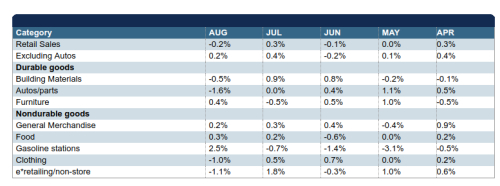

- Total retail sales declined 0.2% (Briefing.com consensus +0.1%) on the heels of a downwardly revised 0.3% increase (from 0.6%) for July.

- Retail sales, excluding autos, increased 0.2% (Briefing.com consensus +0.5%) following a downwardly revised 0.4% increase (from 0.5%) for July.

- The weakness in August was paced by a 1.6% decline in auto sales, which were impacted partly by Hurricane Harvey, as well as a 1.1% decline in nonstore retailers, which was an expected letdown after Amazon's Prime Day boosted July sales.

- Clothing and clothing accessories sales fell 1.0% while sales at electronics and appliance stores and building equipment and materials stores dropped 0.7% and 0.5%, respectively.

- Gasoline station sales rose 2.5% and acted as an offset of sorts to the weakness seen elsewhere.

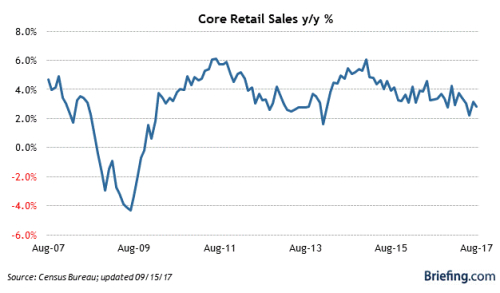

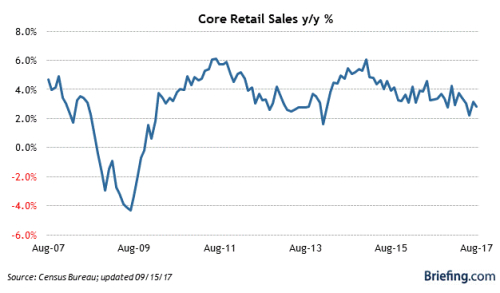

- The key takeaway from the report is that it will temper forecasts for Q3 consumer spending as core retail sales, which exclude auto, gasoline station, building equipment and materials, and food services and drinking places sales, declined 0.2%.