Some time ago I posted an blog post about my working on Currency Strength Meter . The meter was based on rolling of cumulative sums of currency returns. While it seemed to be a good tool for discretionary traders and so it seemed to be a good idea for automation, but hundreds of hours of prototyping and back testing turned out it's competently useless for automation.

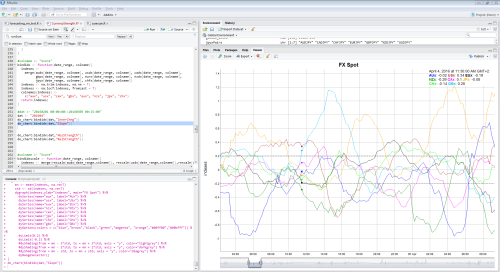

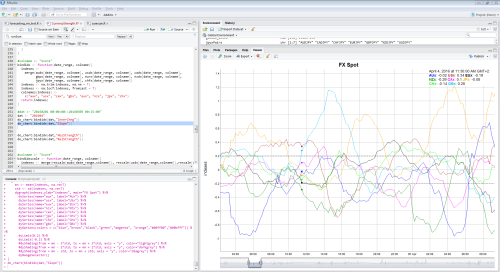

Hence I've come with another idea of currency strength which simply measure real-time slopes of currencies and checking when slope crosses some predefined threshold. IMO this is better approach because it's not "rolling" cumsum but real time strength changing instantly based on moves of the underlying currencies. This is very similar approach being used in signal proccessing, when signal crosses some treshold (standard deviation etc.) it shows that signal (currency slope in our case) shows some imperfection that can be eventually utilized for trading.

I tend to believe that this approach will allow some better coding possibilities than previous one. I've so far made some prototyping in R and I'd like to use quantstrat to backtesting it first before I'll start any serious Java coding.

Hence I've come with another idea of currency strength which simply measure real-time slopes of currencies and checking when slope crosses some predefined threshold. IMO this is better approach because it's not "rolling" cumsum but real time strength changing instantly based on moves of the underlying currencies. This is very similar approach being used in signal proccessing, when signal crosses some treshold (standard deviation etc.) it shows that signal (currency slope in our case) shows some imperfection that can be eventually utilized for trading.

I tend to believe that this approach will allow some better coding possibilities than previous one. I've so far made some prototyping in R and I'd like to use quantstrat to backtesting it first before I'll start any serious Java coding.