FOREXVOLATILITY-Calculation

First I want to apologize for not answering in time, but 1 week I was out. Dukascopy punished me for Spam.In fact I answered one by one for those who make on comment on my article .I think this is polite answer and Dukascopy can count all comments except mine. Is so simple . Realy I didn’t now that this answer is spam.

“”good work and nicely written. the hourly/pair volatily sheet doesn't have any

data??’

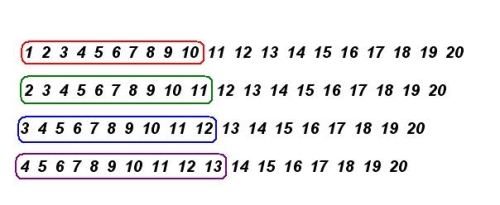

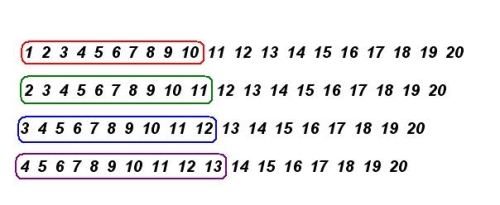

No Victor hourly volatility doesn’t have any data.You know why? Look at next picture :

Every time we cut one day and add a new one. For this reason we must check every day for hourly volatility . That table was a template suggestion .

The following table represent the currency's daily variation measured in Pip, in $ and in % with a size of contract at $100'000. You have to define the period to calculate the average of the volatility. It could be interesting to trade the pair which offer the best volatility.

Formula : Variation = Average(Higher - Lower)

Volatility calculated over the last 10 Weeks We can change which period want ,3 days,7days, but on 10 weeks works better .

Olga I’m not decide when to enter in market .Go to article and you can see 2 rulles;

1.Enter Long(Buy Stop) at 10 pips from upper Bollinger Bands andShort(Sell Stop) at 10 pips under lower band both orders with 20 pips Stop

Loss. This is Set and Forget.

2.Enter Long or Short at MarketPrice if the price cross RSI 50 from down for Long ,and from up to down for

Short .Exit when price cross 70 Level(from Overbought area) for Long ,and 30 Level (from Oversold area) for Short .

One more mention :

This system works on 5 min and 1H, but if we don’t have a clear view on 5 min ,we can check on 10 min or 15 min

This is my article ,I much appreciate if you give a Like and a comment :

A Simple Way to Scalp Forex Market

.

Good Luck at Pips Hunting

A Simple Way to Scalp Forex Market-Details

FOREXVOLATILITY-Calculation

First I want to apologize for not answering in time, but 1 week I was out. Dukascopy punished me for Spam.In fact I answered one by one for those who make on comment on my article .I think this is polite answer and Dukascopy can count all comments except mine. Is so simple . Realy I didn’t now that this answer is spam.

“”good work and nicely written. the hourly/pair volatily sheet doesn't have any

data??’

No Victor hourly volatility doesn’t have any data.You know why? Look at next picture :

Every time we cut one day and add a new one. For this reason we must check every day for hourly volatility . That table was a template suggestion .

The following table represent the currency's daily variation measured in Pip, in $ and in % with a size of contract at $100'000. You have to define the period to calculate the average of the volatility. It could be interesting to trade the pair which offer the best volatility.

Formula : Variation = Average(Higher - Lower)

Volatility calculated over the last 10 Weeks We can change which period want ,3 days,7days, but on 10 weeks works better .

Olga I’m not decide when to enter in market .Go to article and you can see 2 rulles;

1.Enter Long(Buy Stop) at 10 pips from upper Bollinger Bands andShort(Sell Stop) at 10 pips under lower band both orders with 20 pips Stop

Loss. This is Set and Forget.

2.Enter Long or Short at MarketPrice if the price cross RSI 50 from down for Long ,and from up to down for

Short .Exit when price cross 70 Level(from Overbought area) for Long ,and 30 Level (from Oversold area) for Short .

One more mention :

This system works on 5 min and 1H, but if we don’t have a clear view on 5 min ,we can check on 10 min or 15 min

This is my article ,I much appreciate if you give a Like and a comment :

A Simple Way to Scalp Forex Market

.

Good Luck at Pips Hunting