Full report is available here.

Summary

Summary

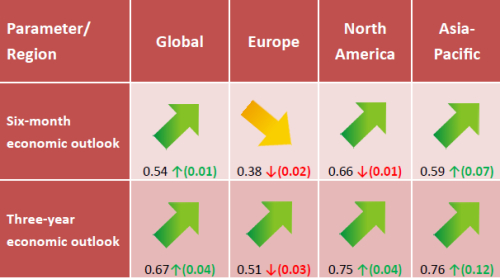

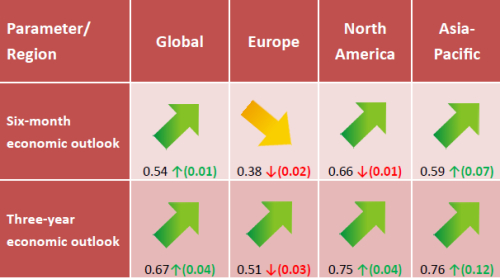

- Having experienced a completely unexpected United Kingdom’s vote to leave the European Union in the referendum that took place on June 23, the global economy is now even further from seeing a continuous upturn, especially in the wake of weak EM performance, economic and political challenges in Europe along with ongoing uncertainty over the upcoming elections in the United States. Nevertheless, despite a steep downgrade of projections for the UK on the back of the ‘Brexit’, professors’ sentiment towards the performance of the world economy seems to have remained relatively unchanged over the observed month, though still indicating sluggish growth.

- Uncertainty over the ’Brexit’ has been dominating the world economic arena for the past month to eventually see the UK divorcing the European Union, which has immediately shaken market volatility worldwide and cut down on economists’ confidence in the bloc in the observed month. The latter has also sent both short and long term sentiment gauges significantly lower in June, indicating the possibility of slower recovery in the common-currency zone.

- While consumer spending, which remained pretty strong in the Q2, along with retail sales that expanded for the second straight month and better-than-expected non-farm payrolls reading managed to boost the US economy, overall, North America saw mixed results in June, as the six-month sentiment inched down slightly, while the three-year measure proved to continue its positive trend.

- The positive momentum in the Asia-Pacific region seems to have continued in June even despite soft global demand and signs that the Chinese investment-led recovery is coming to an end, as both short and long run sentiment indices soared in the measured month.