The start of June sees several of the major Currency Pairs breaking out of strong setups that are leading to Trend Changes. Bull Crowns, ABC Setups and Consolidations are the most common Candlestick Patterns that you will see that lead to trend changes and these can now be seen on some of the EURO crosses.

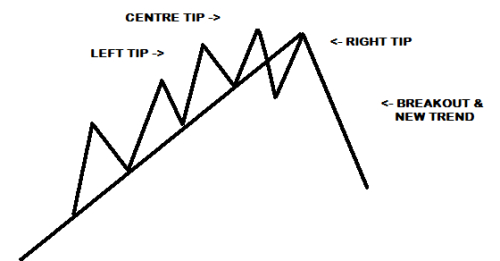

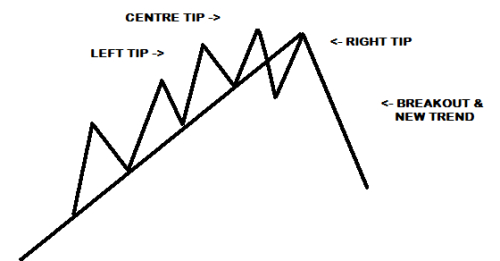

Bull and Bear Crowns, also known as Head & Shoulders Patterns, involves 4 steps that eventually lead to the trend change. The first is the formation of the Left Tip. This is usually the last Setup of the existing trend. It can be a Consolidation or a Counter Trend Line (CTL).

Next is the Centre Tip which can be a U-Turn, Consolidation or Double Tops/Bottoms that lead to the break of a Trend Line. The market will then pullback or sometimes move sideways to form the Right Tip (Consolidation, CTL) before providing a signal that leads to the new trend. This pattern is very common when trends that have been in place for several years are ending.

ABC Setups can also lead to similar changes in trend direction. They can be formed with Consolidations or CTL setups and usually move very quickly to their targets.

They can also be seen at Consolidation Boundaries to signal the start of a False Breakout Reversal that tends to lead to a breakout/start of a trend at the other end.

Spotting these signals early can give allow traders to get in ahead of the rest of the market, maximizing on the gains that will take place with these breakouts. Naturally, the key will be determining which time frame is best to trade them and ensuring that the best and strongest signals are traded.

Bull and Bear Crowns, also known as Head & Shoulders Patterns, involves 4 steps that eventually lead to the trend change. The first is the formation of the Left Tip. This is usually the last Setup of the existing trend. It can be a Consolidation or a Counter Trend Line (CTL).

Next is the Centre Tip which can be a U-Turn, Consolidation or Double Tops/Bottoms that lead to the break of a Trend Line. The market will then pullback or sometimes move sideways to form the Right Tip (Consolidation, CTL) before providing a signal that leads to the new trend. This pattern is very common when trends that have been in place for several years are ending.

ABC Setups can also lead to similar changes in trend direction. They can be formed with Consolidations or CTL setups and usually move very quickly to their targets.

They can also be seen at Consolidation Boundaries to signal the start of a False Breakout Reversal that tends to lead to a breakout/start of a trend at the other end.

Spotting these signals early can give allow traders to get in ahead of the rest of the market, maximizing on the gains that will take place with these breakouts. Naturally, the key will be determining which time frame is best to trade them and ensuring that the best and strongest signals are traded.