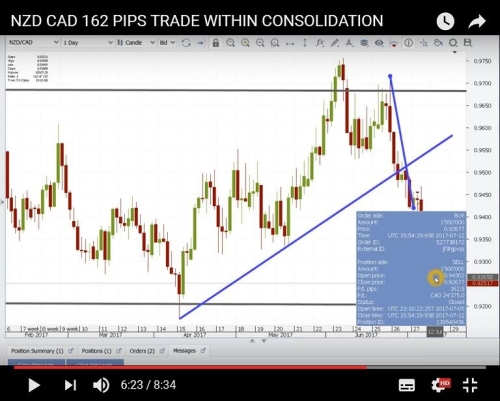

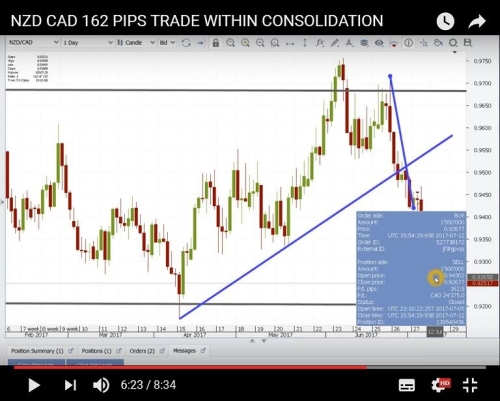

This trade was another Consolidation Setup where the pair gave a Double Top Formation to complete the Resistance Boundary and start a Bearish Move. This would lead to a break of the Uptrend Line to confirm the start of the move down to Support.

DAILY CHART

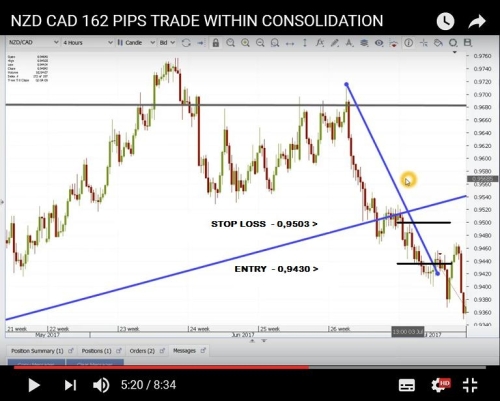

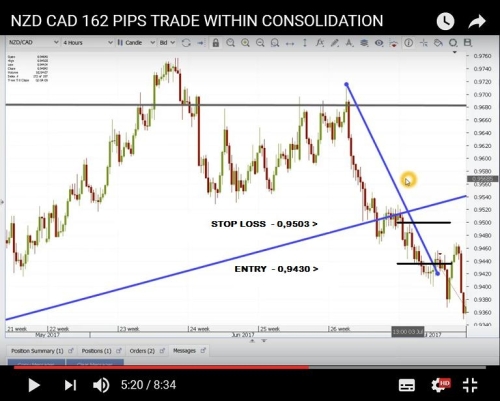

To take advantage of this, I then went down to the 4H Chart. I spotted the downtrend line formed as well as the High of Resistance of an Evening Star Bearish Signal and used that area for my Stop Loss. These 2 on their own are good Stop Loss areas so using both gives us an even stronger Stop Loss.

Entry took place as the market pulled back to enter with a Stop Loss of just over 70 Pips. Target was set to an area just above the Support target and after a few days, market provided the 162 Pip Gain.

DAILY CHARTS

SUMMARY OF TRADE

1. CONSOLIDATIONS OFFER GOOD SETUPS TO TRADE UNTIL BREAKOUT TAKES PLACE

2. DOUBLE TOPS, BREAK OF TREND LINE AND BEARISH SIGNALS INDICATED START OF DOWNTREND

3. HOLDING TRADES FOR 5-7 DAYS IS OFTEN NECESSARY FOR SETUPS AS LARGE AS THIS

4. EXITING JUST BEFORE THE MARKET HITS SUPPORT/RESISTANCE IS IDEAL- MARKET SOMETIMES STARTS TO REVERSE WITHOUT ACTUALLY HITTING BOUNDARY, LEADING TO LOSSES. THEREFORE, CONSERVATIVE THING TO DO IS TO SET THE TARGET JUST AHEAD OF THE SUPPORT/RESISTANCE.

DAILY CHART

To take advantage of this, I then went down to the 4H Chart. I spotted the downtrend line formed as well as the High of Resistance of an Evening Star Bearish Signal and used that area for my Stop Loss. These 2 on their own are good Stop Loss areas so using both gives us an even stronger Stop Loss.

Entry took place as the market pulled back to enter with a Stop Loss of just over 70 Pips. Target was set to an area just above the Support target and after a few days, market provided the 162 Pip Gain.

DAILY CHARTS

SUMMARY OF TRADE

1. CONSOLIDATIONS OFFER GOOD SETUPS TO TRADE UNTIL BREAKOUT TAKES PLACE

2. DOUBLE TOPS, BREAK OF TREND LINE AND BEARISH SIGNALS INDICATED START OF DOWNTREND

3. HOLDING TRADES FOR 5-7 DAYS IS OFTEN NECESSARY FOR SETUPS AS LARGE AS THIS

4. EXITING JUST BEFORE THE MARKET HITS SUPPORT/RESISTANCE IS IDEAL- MARKET SOMETIMES STARTS TO REVERSE WITHOUT ACTUALLY HITTING BOUNDARY, LEADING TO LOSSES. THEREFORE, CONSERVATIVE THING TO DO IS TO SET THE TARGET JUST AHEAD OF THE SUPPORT/RESISTANCE.