The top piece of event risk this week is right ahead of us, and that is FOMC rate decision and the post-announcement press conference from Fed chair Yellen.

The top piece of event risk this week is right ahead of us, and that is FOMC rate decision and the post-announcement press conference from Fed chair Yellen. Today's FOMC decision it will have

broad implication on different assets classes. It's quite important to remember ourselves that this is not just about the rate decision but there are also other elements attached to this which is the

updated forecasts for growth, inflation, employment.

It's quite weird that the FOMC announcement has come down to semantics and syntax of the English language but since that's what the majority of market participants are looking after it's in our best interest to pay attention to this words.

If we see the "patience" word removed from the FOMC statement it will shift that time-frame for the first rate hike to Jun. The Fed funds rate are still suggesting for a rate hike in October, however they can have plenty of time to adjust and discount a Jun rate hike.

- 2015 Reminiscence of 2004

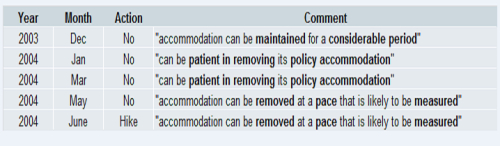

Consensus says Fed will replace “patience” with “gradual” and if history is to provide any guide than we can use the last rate hike cycle to judge how things may unfold (see Figure 1). As traders we must prepare for the unexpected as well and based on the 2004 rate hike cycle FED has NOT removed "patience" from the statement, however this has not altered the rate hike path and they have proceeded with a rate hike in Jun despite keeping the word "patience" in March.

Figure 1. 2004 Rate Hike Cycle Timeline

- US Dollar Market Reaction

This is a significant event risk because the markets have already speculated about the outcome for this particular event because they are speculating on the eventual shift in their monetary policy. Fed is one of the few major central banks around the global that is leaning toward tightening, which is in great contrast with other major CB like ECB, BOJ, PBOC which are easing and because of this precise divergence the US dollar has gain lot of traction.

The US Dollar is already up 14% on this year alone and it has an impressive run and even though in the short term the move may look like overbought, fundamentally speaking there is more space to the upside.

Clearly the Fed has created expectations that it will tighten in either June or September, and such expectations are difficult to deviate from. For those reasons, we expect a Fed tightening and are cautious about our exposures. Ray Dalio

We can play with 3 different scenarios:

- "Patience" is removed from the statement (hawkish Fed)and even though Yellen will try to sound more neutral this will not stop the US Dollar from rallying. this is the highest probability scenario.

- In the second scenario we still have "patience" in the statement (dovish Fed) in which case we'll have a dollar squeeze lower. This scenario is the same with what happened in 2004 (see above).

- Neutral stance in which case we can get a big whipsaw in the short term.

Figure 2. US Dollar Index

Best Regards,Daytrader21