In the first article in this series I outlined some general principles behind the strategy that I'm currently using in the contest. In the second article I described a simple process that can be used to improve the strategy, in terms of its entry signal.

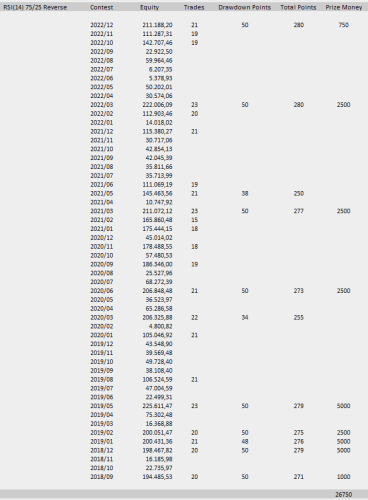

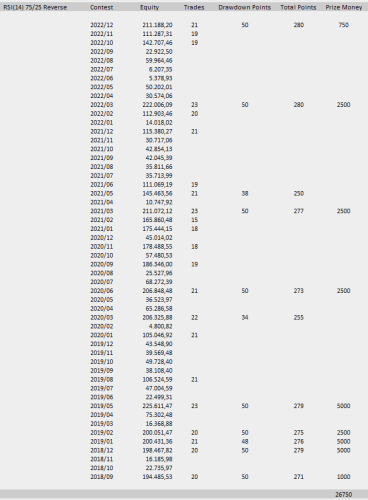

After I published the second article, I also backtested the "reverse" versions of all three strategies. Instead of taking positions in the direction of the short-term momentum, these strategies do exactly the opposite: take mean-reversion trades in overbought/oversold conditions, as implied by indicators. As it turned out, the reverse versions did much better in the backtests and I subsequently decided to use a variant of the RSI(14) 75/25 Reverse strategy.

The strategy hasn't performed as well as in the earlier periods of the original backtest. I also used a slightly different version of the strategy for some months in 2021 (to try and ensure at least 20 trades each month), which probably costed me a prize in March 2021.

Because of differences in implementation of JForex order execution engines and environment in which they operate (test, demo, live), same strategy code may give different results on each of the engines (particularly if there is a small sample of trades), which is why some of the results may differ from those in the standings table.

It would be interesting to see how other strategies have performed, so I may well analyze them and perhaps pick one that has performed better. With less participation in the contest, the prize fund has been reduced lately, but is still decent and you'd struggle to find a more risk-free way to enrich your trading account.

Wish every one a happy, healthy and successful 2023!

After I published the second article, I also backtested the "reverse" versions of all three strategies. Instead of taking positions in the direction of the short-term momentum, these strategies do exactly the opposite: take mean-reversion trades in overbought/oversold conditions, as implied by indicators. As it turned out, the reverse versions did much better in the backtests and I subsequently decided to use a variant of the RSI(14) 75/25 Reverse strategy.

The strategy hasn't performed as well as in the earlier periods of the original backtest. I also used a slightly different version of the strategy for some months in 2021 (to try and ensure at least 20 trades each month), which probably costed me a prize in March 2021.

Because of differences in implementation of JForex order execution engines and environment in which they operate (test, demo, live), same strategy code may give different results on each of the engines (particularly if there is a small sample of trades), which is why some of the results may differ from those in the standings table.

It would be interesting to see how other strategies have performed, so I may well analyze them and perhaps pick one that has performed better. With less participation in the contest, the prize fund has been reduced lately, but is still decent and you'd struggle to find a more risk-free way to enrich your trading account.

Wish every one a happy, healthy and successful 2023!