Hello everyone.

This article will be dedicated to the algorithm that was 1 in December 2023. The name I was participating in was December20231 and this is a detailed explanation of how it works. The operation that forms the basis of this algorithm is a very basic mobile stocking trend system, since it does not use any other support or confirmation indicator to open and close positions and everything is supported by crossing exponential moving stockings. Mobile stockings usually work well when there is a trend and not, when the market displacement is lateral. The content and operation of the December20231 algorithm is as follows:

Mobile stockings. - The moving stockings that have been used are 8 exponential stockings that I have identified with these letters and number of periods: a = 5, b = 21, c = 6, d = 7, e = 8, f = 9, g = 10, h = 11. The last 5 periods have been taken from these moving stockings, as if they were independent moving stockings of a single period. Thus, the moving average of 5 periods uses the 5 periods identified as follows: a1, a2, a3, a4, a5. Of the rest of the mobile means, having more than 5 periods, only the most recent 5 are used, also numbered from 1 to 5, from the most recent to the most distant, coinciding in time all the periods identified with the same number and different letter . In this way, we would have 8 moving averages of a period, with different letters and number 1, another 8 more, with number 2, and so on until number 8 . This would be like 40 1-period stockings grouped from 5 to 5, with 8 associated different letters identifying them.

Temporary Framework.- The time frame that has been used is 4 hours.

Having clarified the components that make up the system and the time frame, we will see the operation or commercial logic that will be followed.

Being a trend system, the first decision was to determine if I wanted to establish a tendency to continue, by position of moving stockings or by crossing and I opted for the crossing of moving stockings.

Mobile stockings crossing.- Establishing the trend with the crossing of mobile stockings is like starting operations in standby mode, since it does not open positions until a stocking crossing occurs and the current trend changes, which is initially ignored due to the lack of conditions. opening.

What should the system understand as Mobile Stockpile Crossing? The definition that has been given to crossing moving stockings to open and close positions in this system is as follows:

Alcista Crossing.- It will be considered an bullish crossing and therefore a change in trend from bassist to bullish, when any of these two situations occur:

Situation 1.- Periods a5, and a4 of the moving mean a must be below periods 5 and 4 respectively of the moving average to be crossed and periods a3, a2 and a1 must be above periods 3, 2 , 1, respectively. It does not matter what mobile average it is, nor how many periods.

Situation 2.- The period a5, of the moving average a must be below period 5 of the moving average that it is going to cross and periods a4, a3, a2 and a1 must be above periods 4, 3, 2 and 1 respectively. It does not matter what mobile average it is, nor how many periods.

Bajista Crossing.- It will be considered a bearish crossing and therefore a change in trend from bullish to bearish, when one of these two situations occurs:

Situation 1.- Periods a5, and a4 of the moving average a must be above periods 5 and 4 respectively of the moving average to be crossed and periods a3, a2 and a1 must be below periods 3, 2 , 1, respectively. It does not matter what mobile average it is, nor how many periods.

Situation 2.- The period a5, of the moving average a must be above period 5 of the moving average that it is going to cross and periods a4, a3, a2 and a1 must be below periods 4, 3, 2 and 1 respectively. It does not matter what mobile average it is, nor how many periods.

Alcist trend and opening of Buy positions.- The system will consider that an upward trend begins that must continue, when the moving average of fewer periods (in this case, would be the mean identified with the letter a ) Cross up any other moving media with more periods that you find in your path according to the definition of mobile stocking crossing. If this occurs, it would open a Buy position.

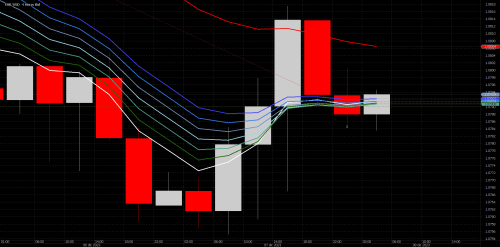

Close Sell and Open Buy.

Close Sell and Open Buy (Expanded).

Low-level trend and opening of Sell positions.- The system will consider that a downward trend begins that must continue, when the moving average of fewer periods (in this case, would still be the mean identified with the letter a ) Cross down any other moving media with more periods that you find in your path according to the definition of mobile stocking crossing. If this occurs, it would open a Sell position.

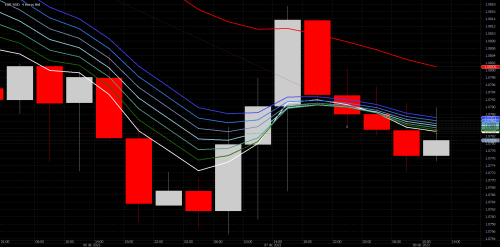

Close Buy and Open Sell.

Close Buy and Open Sell (Expanded).

Closing of Positions.- As the system is symmetrical, when the trend changes, if there were an open position in one direction or another it would close it before opening the position that indicates the new trend.

The basis of the system and most important is the crossing of two moving averages, either up or down. It is not important how many moving averages we have, nor of how many periods that in this specific case, have been those specified in the mobile averages section.

The definition of mobile stocking crossing can be established and customized as desired, with the corresponding modifications.

This article will be dedicated to the algorithm that was 1 in December 2023. The name I was participating in was December20231 and this is a detailed explanation of how it works. The operation that forms the basis of this algorithm is a very basic mobile stocking trend system, since it does not use any other support or confirmation indicator to open and close positions and everything is supported by crossing exponential moving stockings. Mobile stockings usually work well when there is a trend and not, when the market displacement is lateral. The content and operation of the December20231 algorithm is as follows:

Mobile stockings. - The moving stockings that have been used are 8 exponential stockings that I have identified with these letters and number of periods: a = 5, b = 21, c = 6, d = 7, e = 8, f = 9, g = 10, h = 11. The last 5 periods have been taken from these moving stockings, as if they were independent moving stockings of a single period. Thus, the moving average of 5 periods uses the 5 periods identified as follows: a1, a2, a3, a4, a5. Of the rest of the mobile means, having more than 5 periods, only the most recent 5 are used, also numbered from 1 to 5, from the most recent to the most distant, coinciding in time all the periods identified with the same number and different letter . In this way, we would have 8 moving averages of a period, with different letters and number 1, another 8 more, with number 2, and so on until number 8 . This would be like 40 1-period stockings grouped from 5 to 5, with 8 associated different letters identifying them.

Temporary Framework.- The time frame that has been used is 4 hours.

Having clarified the components that make up the system and the time frame, we will see the operation or commercial logic that will be followed.

Being a trend system, the first decision was to determine if I wanted to establish a tendency to continue, by position of moving stockings or by crossing and I opted for the crossing of moving stockings.

Mobile stockings crossing.- Establishing the trend with the crossing of mobile stockings is like starting operations in standby mode, since it does not open positions until a stocking crossing occurs and the current trend changes, which is initially ignored due to the lack of conditions. opening.

What should the system understand as Mobile Stockpile Crossing? The definition that has been given to crossing moving stockings to open and close positions in this system is as follows:

Alcista Crossing.- It will be considered an bullish crossing and therefore a change in trend from bassist to bullish, when any of these two situations occur:

Situation 1.- Periods a5, and a4 of the moving mean a must be below periods 5 and 4 respectively of the moving average to be crossed and periods a3, a2 and a1 must be above periods 3, 2 , 1, respectively. It does not matter what mobile average it is, nor how many periods.

Situation 2.- The period a5, of the moving average a must be below period 5 of the moving average that it is going to cross and periods a4, a3, a2 and a1 must be above periods 4, 3, 2 and 1 respectively. It does not matter what mobile average it is, nor how many periods.

Bajista Crossing.- It will be considered a bearish crossing and therefore a change in trend from bullish to bearish, when one of these two situations occurs:

Situation 1.- Periods a5, and a4 of the moving average a must be above periods 5 and 4 respectively of the moving average to be crossed and periods a3, a2 and a1 must be below periods 3, 2 , 1, respectively. It does not matter what mobile average it is, nor how many periods.

Situation 2.- The period a5, of the moving average a must be above period 5 of the moving average that it is going to cross and periods a4, a3, a2 and a1 must be below periods 4, 3, 2 and 1 respectively. It does not matter what mobile average it is, nor how many periods.

Alcist trend and opening of Buy positions.- The system will consider that an upward trend begins that must continue, when the moving average of fewer periods (in this case, would be the mean identified with the letter a ) Cross up any other moving media with more periods that you find in your path according to the definition of mobile stocking crossing. If this occurs, it would open a Buy position.

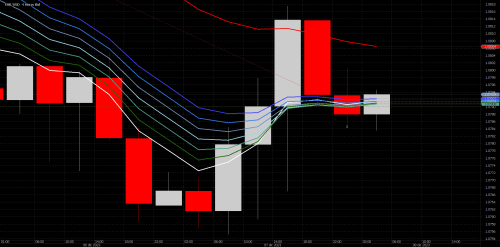

Close Sell and Open Buy.

Close Sell and Open Buy (Expanded).

Low-level trend and opening of Sell positions.- The system will consider that a downward trend begins that must continue, when the moving average of fewer periods (in this case, would still be the mean identified with the letter a ) Cross down any other moving media with more periods that you find in your path according to the definition of mobile stocking crossing. If this occurs, it would open a Sell position.

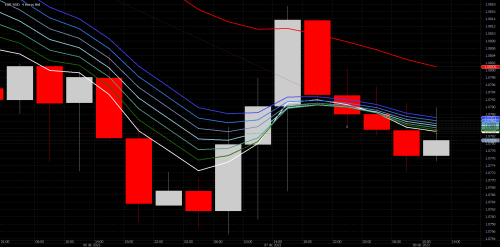

Close Buy and Open Sell.

Close Buy and Open Sell (Expanded).

Closing of Positions.- As the system is symmetrical, when the trend changes, if there were an open position in one direction or another it would close it before opening the position that indicates the new trend.

The basis of the system and most important is the crossing of two moving averages, either up or down. It is not important how many moving averages we have, nor of how many periods that in this specific case, have been those specified in the mobile averages section.

The definition of mobile stocking crossing can be established and customized as desired, with the corresponding modifications.