Yesterday,except the pound, it was a day of calm, with low volume and little movement, for today I hope something more motion, we will see that we have today.

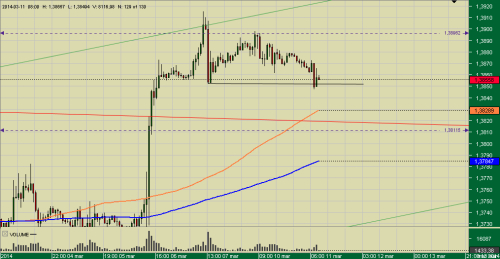

EUR/USD

Worse than expected in the German trade balance data have led the euro to lows at 1.3847, and is now fighting with the last Friday at 1.3850 minimum, if he breaks this level will surely see the price go down to support 1.3820-10. if it dont break and stand at 1.3850 holds the price will make a new test to 1.3920.

today U.S. wholesale inventories data is expected to improve what could take a pair to the zone of resistance at 1.3820-10.

No forget that yesterday members of the ECB began has show its measured by the strong appreciation of the euro, so that it is possible to see statements this week on negative and other deposits.

GBP/USD

Pound yesterday broke down a triangle symmetric that was formed in the last consolidation from highs for today have an appearance of the authorities of the BOE in the Parliament can bring volatility to the market.Possibly today the pair attempt to bounce to the broken line of the triangle, although it seems that the downward correction if he breaks the last minimum in 1.6590 could continue to 1.65 and confirm the double top is in formation on the daily chart.

USD/JPY

The BOJ meeting has brought little volatility to the pair and as expected has continued the same ultra flexibility measures, for today the pair remains in consolidation on 103 and if U.S. data improve, once the climate has improved, we see the couple again attacking 103.88 area where the next resistance.

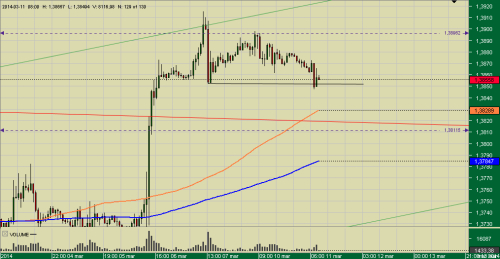

EUR/USD

Worse than expected in the German trade balance data have led the euro to lows at 1.3847, and is now fighting with the last Friday at 1.3850 minimum, if he breaks this level will surely see the price go down to support 1.3820-10. if it dont break and stand at 1.3850 holds the price will make a new test to 1.3920.

today U.S. wholesale inventories data is expected to improve what could take a pair to the zone of resistance at 1.3820-10.

No forget that yesterday members of the ECB began has show its measured by the strong appreciation of the euro, so that it is possible to see statements this week on negative and other deposits.

GBP/USD

Pound yesterday broke down a triangle symmetric that was formed in the last consolidation from highs for today have an appearance of the authorities of the BOE in the Parliament can bring volatility to the market.Possibly today the pair attempt to bounce to the broken line of the triangle, although it seems that the downward correction if he breaks the last minimum in 1.6590 could continue to 1.65 and confirm the double top is in formation on the daily chart.

USD/JPY

The BOJ meeting has brought little volatility to the pair and as expected has continued the same ultra flexibility measures, for today the pair remains in consolidation on 103 and if U.S. data improve, once the climate has improved, we see the couple again attacking 103.88 area where the next resistance.