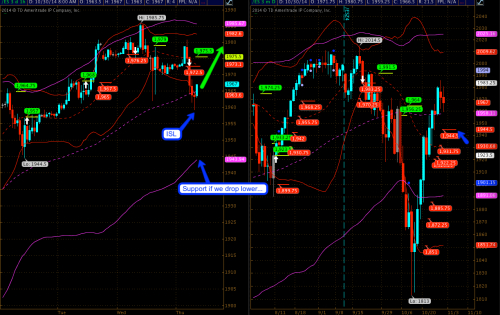

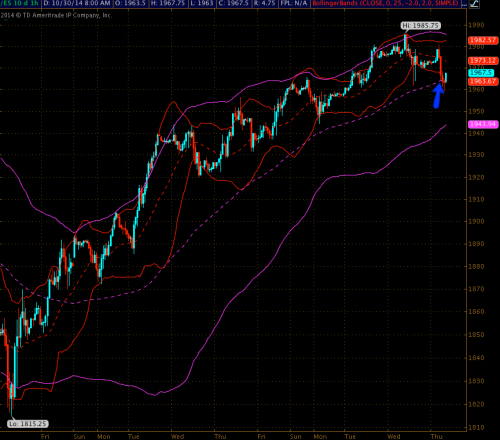

Equities have dropped a little lower overnight and we're now testing the 100-hour SMA. If I wasn't long already in my ongoing campaign I would be here with a stop below ~1958. If supports fails then the next probable scenario is a visit of the lower 100-hour BB which coincides with NLSL at 1944.5.

Here's another view at the scenario on the hourly panel - the onus is now on the bulls to keep up the pace or we run the risk of a little correction.

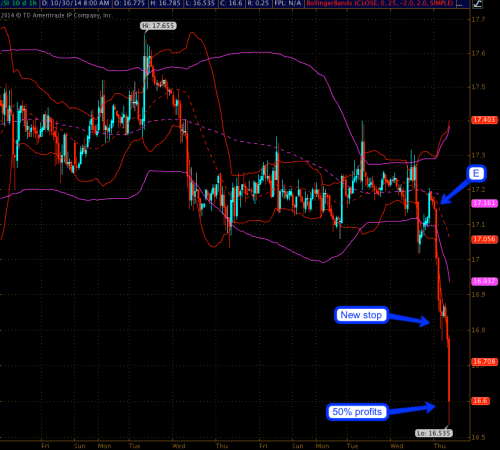

Platinum was one of our short setups from last night and it's been very favorable so far. Time to move your stop to b/e and to take 50% off the table.

Silver was the second one and here I'm moving my stop to 1.2R and also take 50% off the table. After such a drop odds are we're going to see a little counter response.

My only setup this morning so I'll throw it out for free - AUD/NZD. Possible buy here at the NLSL with a stop pretty nearby below 1.124 (the rising SMA). Time for this one to get a move on, so I'll give it three candles or so and if she doesn't budge I'm out.

Original post at Evil Speculator.